Your employees clock in, they clock out, and you pay them for the hours they work. It’s a simple process, right?

Not quite. What happens when they start work early, stay late, or handle certain tasks outside their regular hours? If you’re not accurately tracking and compensating them for those hours, you’re not just risking unhappy employees — you’re potentially ignoring federal and state labor laws.

That’s why an effective timekeeping policy is more than just convenient — it’s necessary. Without one, the simplicity of ‘clock in, clock out’ can become a quicksand of inaccuracies that can pull your small business down.

In this article, we’ll guide you step-by-step in creating a timekeeping policy that’s fair and compliant, so you can confidently navigate the complexities of employee timekeeping and protect your business.

What is a Timekeeping Policy?

A timekeeping policy is a set of guidelines that a business establishes to monitor and record its employees’ working hours. It typically addresses things like regular working hours, overtime, break time at work, vacation, sick leave, and other forms of paid or unpaid time off. They also normally detail procedures for handling disputes about recorded time or instances of noncompliance with the policy.

Creating and enforcing a timekeeping policy is also required by law in many countries, including under the Fair Labor Standards Act (FLSA) in the United States. While the FLSA doesn’t require business owners to use time clocks, time cards, or any other specific timekeeping system, they’re required to maintain accurate records of hours worked by nonexempt employees for a minimum of 3 payroll years.

What to Include in a Timekeeping Policy

Every small business is different. While your timekeeping policy should be tailored to your business needs, here’s what a basic policy should include:

Timekeeping Policy Objectives

First off, your timekeeping policy should explain why it’s essential and how it benefits both your small business and the employees.

Consider these examples:

- “Our policy ensures fair pay by accurately recording everyone’s work hours.”

- “We use this policy to eliminate any confusion about pay and work hours, so we can all focus on the job at hand.”

Focus on the benefits of having a timekeeping policy rather than the potential consequences of failing to comply.

| ⚠️ Remember: While you should mention the benefits of your timekeeping policy, don’t over-promise. Set realistic expectations that your company can consistently meet. |

Scope of the Policy

This section defines who’s covered under the policy, especially if you have exempt and nonexempt employees, as defined by the FLSA.

|

Exempt employees |

Nonexempt employees | |

|

Definition |

Exempt employees are those who are exempt from the overtime pay requirements of the Fair Labor Standards Act (FLSA) due to their job duties and salary levels. |

Nonexempt employees are eligible for overtime pay under the FLSA. |

| Pay | They are typically paid a fixed salary that does not vary based on the number of hours worked. |

They can be paid hourly, salary, or on a piece-rate basis. |

| Overtime | Exempt employees are not entitled to overtime pay, regardless of how many hours they work beyond the standard 40-hour workweek. |

Nonexempt employees are entitled to overtime pay for hours worked beyond 40 in a workweek, typically at a rate of one-and-a-half times their regular pay rate. |

Updates for 2024

The U.S. Department of Labor (DOL) has proposed changes to the salary thresholds for exempt employees, which are expected to be finalized sometime in 2024[1][3]. The proposed rule would increase the minimum salary requirements for the executive, administrative, and professional (EAP) exemptions.

The current federal minimum salary threshold for exempt employees is $684 per week ($35,568 annually). However, the proposed rule would increase this threshold to $1,059 per week ($55,068 annually).

The minimum salary for the highly compensated employee (HCE) exemption would also increase from $107,432 per year to $143,988 per year, with the possibility of the threshold being even higher based on earnings data at the time the final rule takes effect.

It’s important to note that some states have their own salary and duties tests for determining whether an employee is exempt from overtime, and these state laws can be more protective than federal law. Employers must follow the law that provides the greater protection to employees

| 💡Tip: Having one company-wide timekeeping policy means all team members understand how their employer operates their small business. It provides clarity, helps maintain uniformity, makes for easy revisions, and reduces the risk of costly mistakes or litigation. |

General Overview

This is where you’ll provide an overview of your small business’s expectations on working hours, overtime, and leave. You should also cover how the policy will be enforced and any potential consequences for noncompliance.

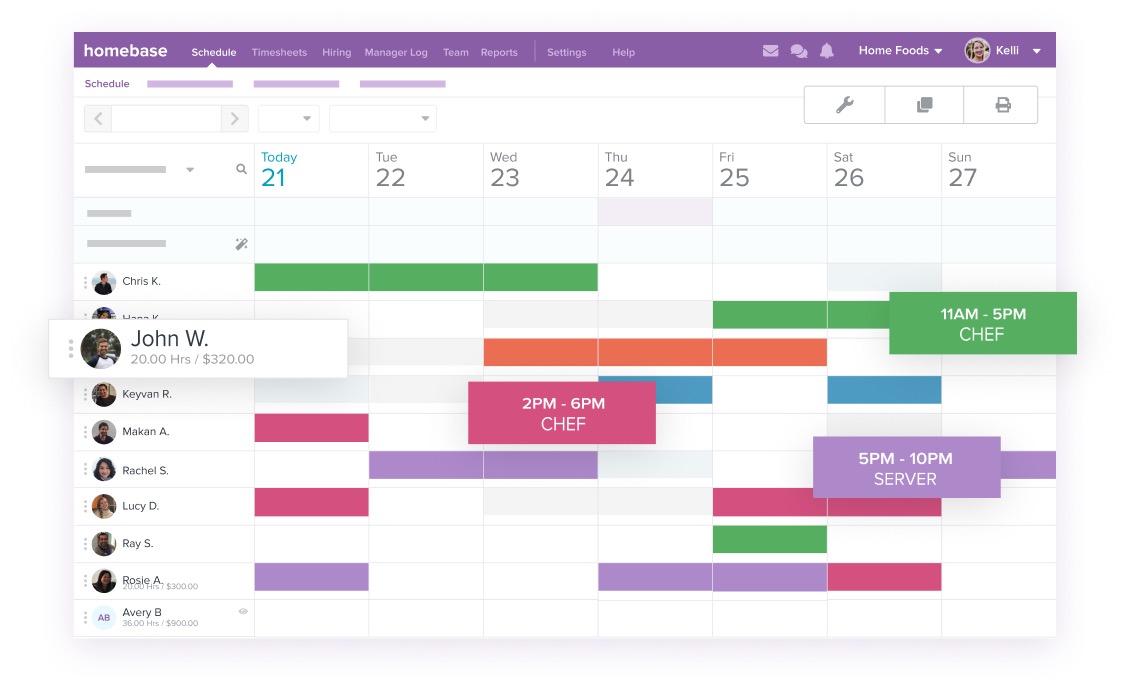

For example, if you’re using a tool like Homebase timesheets, you can explain to employees that they’ll be able to view their wages and overtime data before payday.

Here’s a template you can easily adapt for your own small business:

- Working hours and workdays: Our standard work week runs from Monday to Friday, with a standard workday being eight hours long, typically from 9:00 am to 5:00 pm. We follow all state and federal laws on breaks and meal periods: that includes a 30-minute lunch break at 1:00 pm and two 15-minute breaks, one in the morning and one in the afternoon. Any changes to this schedule, including overtime, need to be approved by a supervisor.

- Overtime: At our small business, overtime work is any work performed beyond the standard 40-hour workweek. Nonexempt employees are eligible for overtime pay at a rate of one and a half times their regular rate of pay for any hours worked beyond 40 in a workweek. All overtime work must be pre-approved by a supervisor.

- Exempt and nonexempt employees: Employees are classified as either exempt or nonexempt under FLSA regulations. Nonexempt employees are eligible for overtime pay, while exempt employees aren’t eligible for overtime pay but are expected to fulfill the responsibilities of their roles. Feel free to talk to management if you aren’t sure if you’re an exempt or nonexempt employee.

- Sick pay: If you can’t work due to illness or injury, we’ll pay you 75% of your regular wages for up to three days.

- Holiday pay: Holiday pay is the special compensation we provide to employees during holidays. Depending on your circumstances, it might be in the form of complete or partial paid time off, a bonus, or extra pay for hours worked on holiday days.

- Employee time off requests: Our team members are entitled to 14 days of paid vacation and seven days of paid personal leave — including sick leave and personal time off for family emergencies, appointments, or personal needs — per year. You can take vacation and leave in full-day increments or split it into half-days.

- Timekeeping records: Employees have to accurately record the time they work every day with the Homebase time clock. That way, all records will be kept up-to-date and accessible for management to review on a regular basis.

Employee Responsibilities

Clear guidelines for clocking and clocking out of work can prevent time theft and ensure people’s working hours are tracked accurately. For example, if an employee signs into their shift later than their allotted time but gets paid for all their scheduled hours, it will add to your labor costs unnecessarily. That’s because you’re paying for more hours than they actually worked.

To prevent this, consider using time tracking software like Homebase. The time clock tool allows employees to clock in and out of work anytime and anyplace. It also includes features like geofencing and photo check-ins to reduce time theft and buddy punching.

But the timesheet procedure for each type of employee category can be different. For example, salaried employees may be required to only log time spent working beyond their regular hours, such as overtime, or instances of paid time off, like sick leave or vacation time. On the other hand, hourly employees are typically required to record whenever they start work, take breaks, resume work, and finish for the day.

Maintaining separate processes and systems for each employee category manually can be time-consuming. With Homebase, all your employee timesheet procedures are managed in one place – they can log their hours, apply for leave, and record overtime seamlessly. This way, you can handle logs, verifications, and permissions automatically within the app, reducing the potential for errors.

Attendance and Tardiness Policies

Tardiness in the workplace can affect productivity and morale. You should outline expectations for reporting absences and tardiness, like arriving more than five minutes late for work or returning late from breaks. For example, employees are required to notify their supervisor of an absence at least two hours before their scheduled start time.

If an employee is going to be late by 10 minutes or less, your policy can say, “Please inform your supervisor by phone, text, or email as soon as you realize the delay. Try to provide an estimated time of arrival so that any necessary adjustments can be made”. And if an employee is going to be late by 60 minutes or more, the policy could state, “In some cases, depending on the nature of your work and the reason for your delay, you may be required to make up for the lost time.”

Plus, if you’re using a tool like Homebase, you can set up alerts to avoid staff accidentally rolling into expensive overtime and send team members reminders to take their breaks and clock out of work on time so your small business stays compliant.

Disciplinary Action

Be sure to communicate the seriousness of sticking to your timekeeping policy and outline the repercussions for employees who don’t comply. Typically, these measures should follow a progressive scale, escalating with each subsequent violation to encourage better behavior and policy compliance.

Here’s what disciplinary action might look like:

- First violation: The supervisor issues a verbal warning, reminding the employee of the importance of accurate timekeeping and the policy in place.

- Second violation: If noncompliance continues, the supervisor gives a written warning, which also serves as a formal record of the employee’s violation.

- Third violation: The disciplinary action escalates to a final warning or even suspension without pay for a specified period if the employee still disregards the policy.

- Further violations: Continued noncompliance could lead to more severe consequences, including termination of employment.

Benefits of Using a Timekeeping Policy

Implementing a timekeeping policy for your small business can help you set clear expectations, promote transparency, and ensure fairness. It ultimately builds a healthier work environment that runs smoothly and fosters both growth and productivity.

Here are some additional benefits to consider:

- It leads to accurate tracking of hours worked, overtime, and paid time off, ensuring compliance with labor laws and error-free payroll.

- It boosts productivity by emphasizing the importance of punctuality and regular attendance.

- It simplifies dispute resolution over hours worked or pay received by providing definitive records.

- It eases employee scheduling in sectors that require shift work or have peak periods like local restaurants during lunch and dinner rushes or a boutique store during the holiday shopping season.

- It assists in monitoring overtime trends, supporting budget control, and forecasting.

Revamping Timekeeping for 2024

In 2024, the approach to managing work hours and related costs is evolving, with a strong push for better integration of systems.

The focus is on improving how employee hours are recorded, managing labor costs more efficiently, and keeping accurate tabs on project progress. The distinction between salaried and hourly employees is also getting sharper attention, aiming to establish clear policies for both groups to support both ease of administration and adherence to regulations.

Given these shifts, your timekeeping strategy for 2024 should embrace these technological strides, adopting advanced time tracking and payroll solutions to accurately manage labor expenses and meet legal standards.

Clocking Out: Ready to set up your Timesheet Policy?

A good timekeeping policy keeps your small business fair, efficient, and on track. It’s not just about creating rules — it’s about making work better for everyone.

But with the complexities of labor regulations, employee expectations, and the task of tracking hours worked, overtime, and absences, it can be challenging to set up timekeeping policies that balance company needs and employee rights.

With a platform like Homebase, you can easily set up a seamless, easy-to-follow time tracking system that requires little to no training and get access to HR and compliance tools and payroll processing all under one roof. That means you can keep track of employee hours, automatically generate timesheets that are ready for payroll, stay compliant with local regulations, and pay team members in one intuitive place.

Because timekeeping is more than ticking boxes, it’s a strategic asset of your company’s most precious resource — time.