S corporations can take advantage of retirement plans. However, there are certain rules you have to follow when it comes to contributions and retirement plans for S corporations. Learn about the various types of retirement plan options for S Corps and how to handle S Corp retirement contributions the right way.

S corporation overview

What exactly is an S corporation? For those of you who don’t know, an S Corp is a type of corporation that is a separate legal entity from its owners.

S corporation owners (aka shareholders) have pass-through taxation and limited liability protection. With pass-through taxation, an S Corp is only taxed at the personal level because the taxes pass through the company and onto the business owner.

S corporation owners receive both wages and distributions. However, they are taxed differently. And, the type of income owners earn can play a role in retirement (which we’ll get into next).

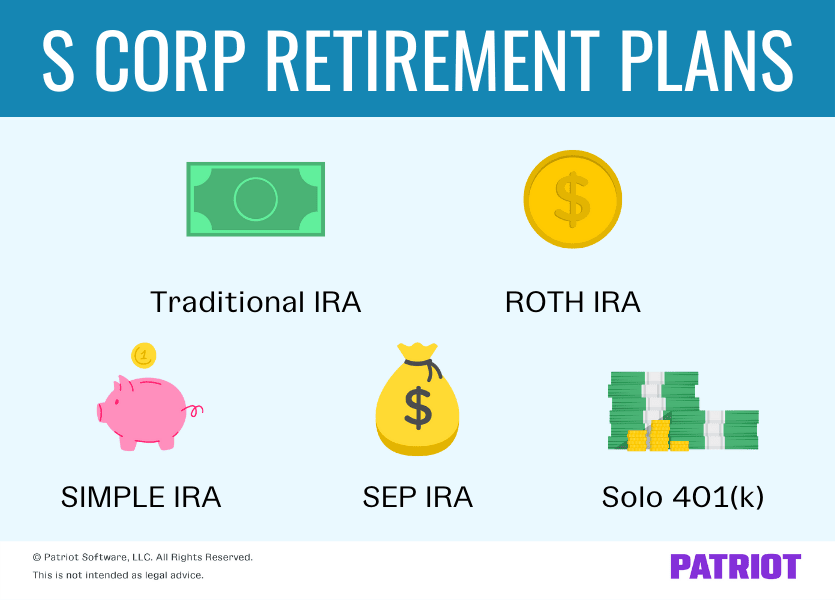

S Corp retirement plans

There are a lot of S Corp retirement plan options out there. And, they each come with their own rules. Here are a few of the most common retirement plans for S Corp owners:

- Traditional IRA: A tax-advantaged personal savings plan where contributions may be tax-deductible.

- ROTH IRA: Tax-advantaged personal savings plan where contributions are not deductible but qualified distributions may be tax-free.

- SIMPLE IRA: A SIMPLE IRA plan allows employees and employers to contribute to traditional IRAs set up for employees.

- SEP IRA: A plan that allows employers to contribute to traditional IRAs (SEP IRAs) set up for employees.

- Solo 401(k): A traditional 401(k) plan designed specifically for a business owner or self-employed individual with no employees apart from their spouse or business partners.

Keep in mind that rules and contribution limits can vary depending on the retirement plan your S Corp has. If you’re looking into setting up a retirement plan for your S corporation, do research to determine which type is the best fit for your business.

S Corp retirement contributions

When it comes to S Corp contributions for retirement, there are a few questions you may have. After all, things can work very differently with 401(k) contributions if you’re both the owner and employee of your S corporation. Not to mention, rules for S Corp 401(k)s can vary in general.

To ensure you fully understand S Corp retirement plan contributions before establishing a plan for your company, check out these handy S Corp 401(k) questions and answers for IRAs.

What income can you contribute to a 401(k)?

You can only contribute income that you report on Form W-2 to a 401(k). You cannot make 401(k) contributions from net profit income or dividends from your Schedule K-1. Income and dividends not reported on Form W-2 are not eligible for contribution.

If you want to minimize your W-2 wages for self-employment tax purposes, consider your 401(k) contributions and plan your annual salary.

How do contributions work if you’re a shareholder and an employee of an S Corp?

You can only make contributions to a retirement plan from compensation. Distributions you receive as a shareholder do not count as earned income for retirement plans.

What about 401(k) contributions for other employees?

According to the IRS, common-law employees of an S corporation can make salary deferral contributions to the 401(k) plan based on their Form W-2 compensation. The employer can also make matching or nonelective contributions to the plan based on the common-law employee’s Form W-2 compensation.

A common-law employee is an individual who, under common law, would have the status of an employee. Common-law employees perform services for an employer who has the right to control and direct the results of the employee’s work and the way it’s done. For example, an employer provides the employee’s tools and materials.

How do you handle contributions to a self-employed plan?

Based on IRS rules, you can’t make contributions to a self-employed retirement plan from S Corp distributions.

Where can you find more information on handling S Corp retirement contributions?

You can check out the IRS’s website under Retirement Plans to learn more about contribution rules and requirements for S corporations.

This is not intended as legal advice; for more information, please click here.