Embroker’s annual Startup Insurance Benchmarking Report: 2022 Snapshot has finally arrived.

The Startup Insurance Benchmarking Report is part of a series of reports from Embroker. They are designed to provide an insightful, comparative look at business insurance coverage and costs for startups.

The Startup Snapshot analyzes the costs and benefits of business insurance at various stages of startup growth. This, along with several other takeaways, will help them make smarter, more confident buying decisions when it comes to protecting their business.

But beyond cost, the Benchmarking Report also gives entrepreneurs insight into insurance trends that reach beyond their wallets. Our data snapshots are derived from almost 5,000 Embroker individual policyholders, and look at real-world purchasing data (not off-the-shelf pricing information).

In our startup insurance benchmarking report we offer insights into startup trends that don’t make it into the headlines.

When it comes to insurance and risk transference, money talks.

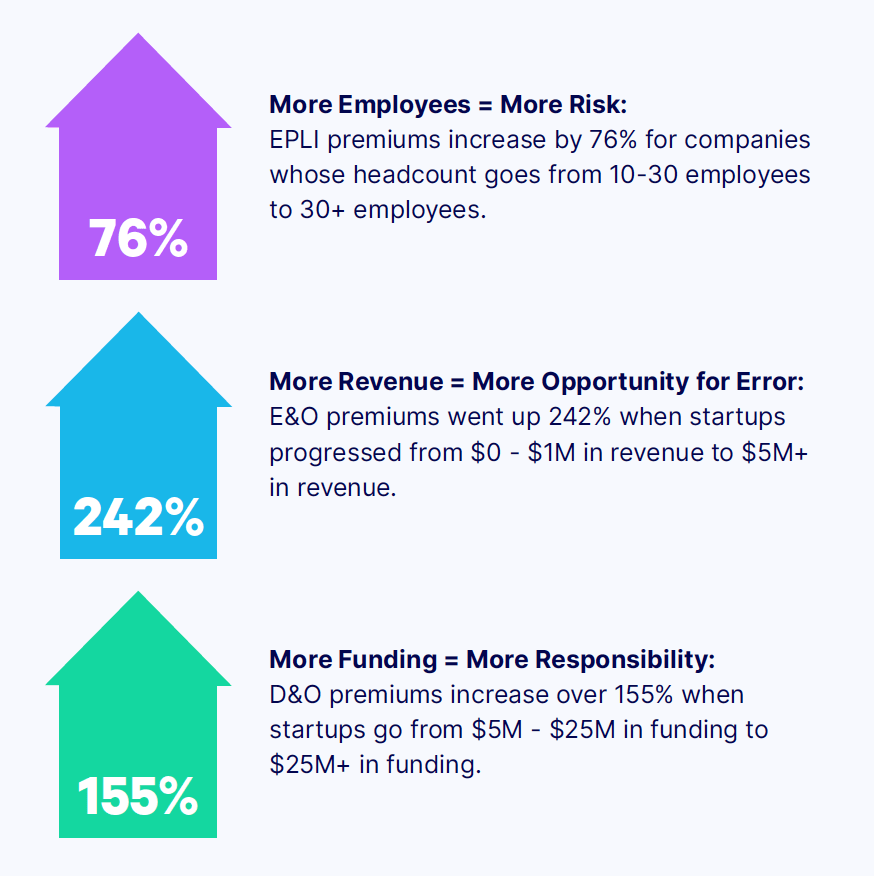

Startup Insurance Benchmarking Key 2022 Insights:

Over the past year, venture-backed technology startups have enjoyed a record fundraising environment – U.S. VC-backed companies raised $329.9 billion in 2021 – and many have grown in both revenue and headcount.

On the other hand, startups, as well as companies of all sizes, had to contend with other risks in the past year, from cyber attacks to supply chain issues to workplace discrimination and equity concerns.

According to an article posted on LinkedIn, hacking has increased over 600% due to business’ being forced to operate online during the global pandemic.

The intersection of this unprecedented growth in funding and increase in business risk heightens the level of responsibility for startups to protect their business, investors, employees and intellectual property.

Risk is inherent in the startup journey. With insights and data like this, founders can navigate Silicon Valley with confidence.

To get the entire report, download it below.

Analyzing Insurance Costs for Startups

Embroker Vertical Insurance Index

How much are you paying for your insurance? Are you purchasing the right policies? Find out what founders are doing, and the trends that you may not have seen.

But, as we all know, every startup, let alone every founder, is different.

Averages and trends are important for determining market pressures, but for individual business budgets, founders need more concrete numbers.

Budgeting for insurance is important but can be confusing if your company is going through a growth spurt. Your insurance costs will likely change frequently in your startup’s early stages, but you can predict when these changes will occur and how much each change will cost.

The cost of your insurance depends on:

- Which policies you need

- How many people are covered

- How much funding you have

- Your estimated annual revenue

Taking these variables into account, we’ve created the Startup Insurance Calculator. With this tool, you can estimate the price of insurance for your startup by finding the average costs for similar companies.

Check out the tool and find out what you might pay for your insurance needs below.

Startup Insurance Calculator

Find out how much your startup can expect to pay for key insurance coverages.

But, we’ve got more where this came from. For more informational content like our Startup Insurance Benchmarking Report, tools like our Startup Calculator, and even more than that, check out our blog.

Related Articles

How to Conduct a Law Firm Risk Assessment

6 min read“Taking risks doesn’t mean shirking responsibility, but embracing possibilities.” – Vick Hope Especially if that responsibility is conducting a law firm risk assessment. Leave it to an author and journalist to have a way with words, right? While applicable to anyone’s professional or personal life, we think this quote rings especially true for attorneys and […]

How to Develop a Cybersecurity Policy for Law Firms

5 min readIf you’re a managing partner or an operations manager at a law firm, there’s so much on your to-do list. So, while you’re at it, can you develop a cybersecurity policy for law firms? Between HR responsibilities, business owner duties, the actual functions of being an attorney, you’re also in charge of keeping your firm’s […]