How do retirement benefits and participation compare by company size?

After years of instability in the global economy and the reduced availability of pension plans, employees are becoming more focused on their financial situations after retiring.

Saving and planning for retirement is one of the most valued workplace benefits, according to the Society for Human Resource Management, which rates retirement benefits as the second highest benefit after health insurance. In fact, 20 percent more employees said retirement benefits were a good reason to stay with a company in 2022 versus 2010, according to a recent survey by the insurance advisory firm WTW.

Research continues to show that retirement benefits are becoming more and more important to employees. To better understand this trend, we used benefits data from the Bureau of Labor Statistics to compare how retirement benefits and employee participation have changed across companies of different sizes over the past decade. This data focuses on the private sector and includes employees nationwide.

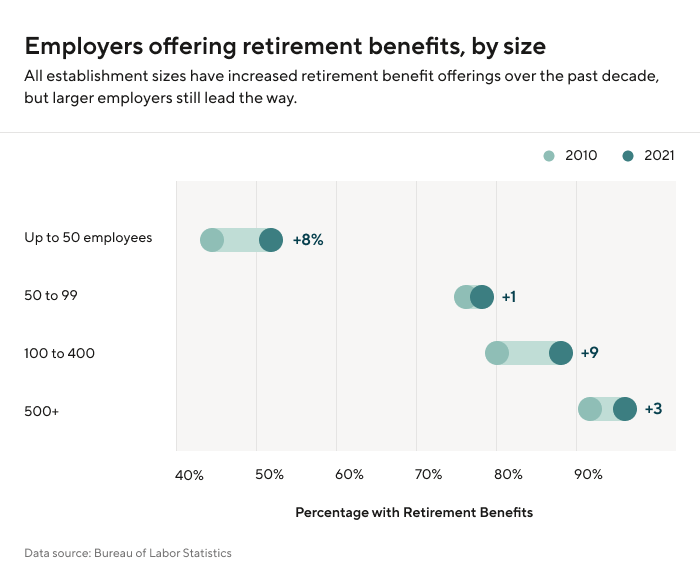

Through this analysis, the data findings show that more than half of private industry employers offered some form of retirement benefits in 2021. The rate was about the same for companies with fewer than 100 employees (58%), but a much higher percentage of companies (87%) with more than 100 employees offered retirement benefits. All establishment sizes have increased retirement benefit offerings over the last decade.

Keep reading to see more specific breakdowns by company size and employee participation.

Private employers of all sizes have expanded retirement offerings

More companies of all sizes in the U.S., from small startups to the larger conglomerates, have begun offering retirement benefits over the past decade, according to data from the Bureau of Labor Statistics.

One potential reason for this is that fewer young workers expect Social Security benefits to still exist by the time they retire. In 2016, a Social Security Administration survey found that about 90% of workers aged 55 to 64 expected to receive Social Security benefits when they retired, but less than half of workers ages 18 to 34 expected the same. Yet in 2021, a Gallup survey showed that Social Security is the top source of income for retirees.

If younger workers don’t expect to receive a significant amount of Social Security income, they'll be looking for other investment opportunities, such as employer-assisted retirement plans, to help them save for the future.

Research from the Pew Trusts in 2017 may explain why smaller and larger businesses have different offerings. Small companies tend to wait to implement retirement plans as they evolve from their initial startup stages, adding later during periods of growth to attract and retain employees.

Consistent with the Bureau of Labor Statistics, a report from the Center for Retirement Research at Boston College found that smaller companies are less likely to offer retirement benefits.That study found that when it comes to company sizes, smaller firms are much less likely to offer retirement plan benefits. The expense this can present to small businesses is one reason why many don't offer retirement plans, and others choose to curb the costs by not matching contributions.

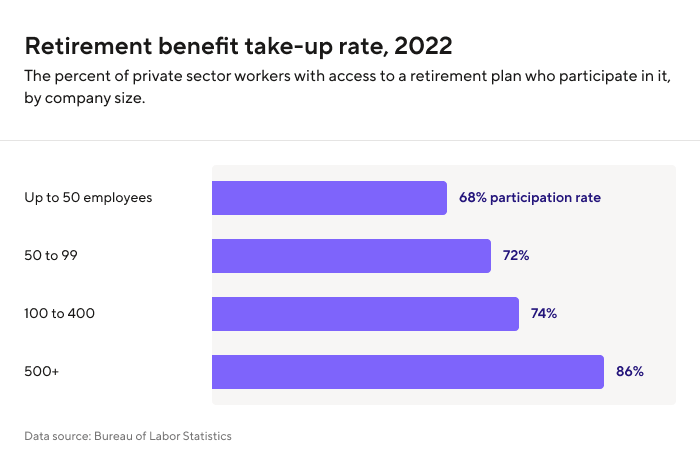

The majority of employees with access to retirement plans participate in them

At least 68% of all private sector employees who have the opportunity to participate in a retirement plan do so, with the highest participation rate among companies with 500 or more employees.

A Department of Labor and the Internal Revenue Service report found that retirement benefits can boost employee retention, which can help companies keep talented workers and reduce turnover in the long run. The report also notes that employees enrolled in retirement plans by default are more likely to participate in those plans and increase participation rates.

What does this mean?

The data shows that private employers of all sizes have expanded retirement offerings. Employees are responding to this behavior, with the majority of employees with access to retirement plans participating in them. With more and more employees placing emphasis on planning for the future, having this benefit offered can be a huge differentiator in the workplace.

Disclosures:

The information provided herein is general in nature and is for informational purposes only. It should not be used as a substitute for specific tax, legal and/or financial advice that considers all relevant facts and circumstances. You are advised to consult a qualified financial adviser or tax professional before relying on the information provided herein.