Have you wondered if there is more you could be offering your employees from a benefits perspective? It’s a question we get asked a lot and when it comes to attracting and retaining top talent, offering a comprehensive benefits package can be the deciding factor between your business and competitors.

As if those stakes weren't high enough already, there's also this: employee benefits are typically one of the biggest expenses for a business. Crafting a well-designed employee benefits program is a careful balancing act - one which requires thoughtful consideration for both your bottom line and the desires of your workforce.

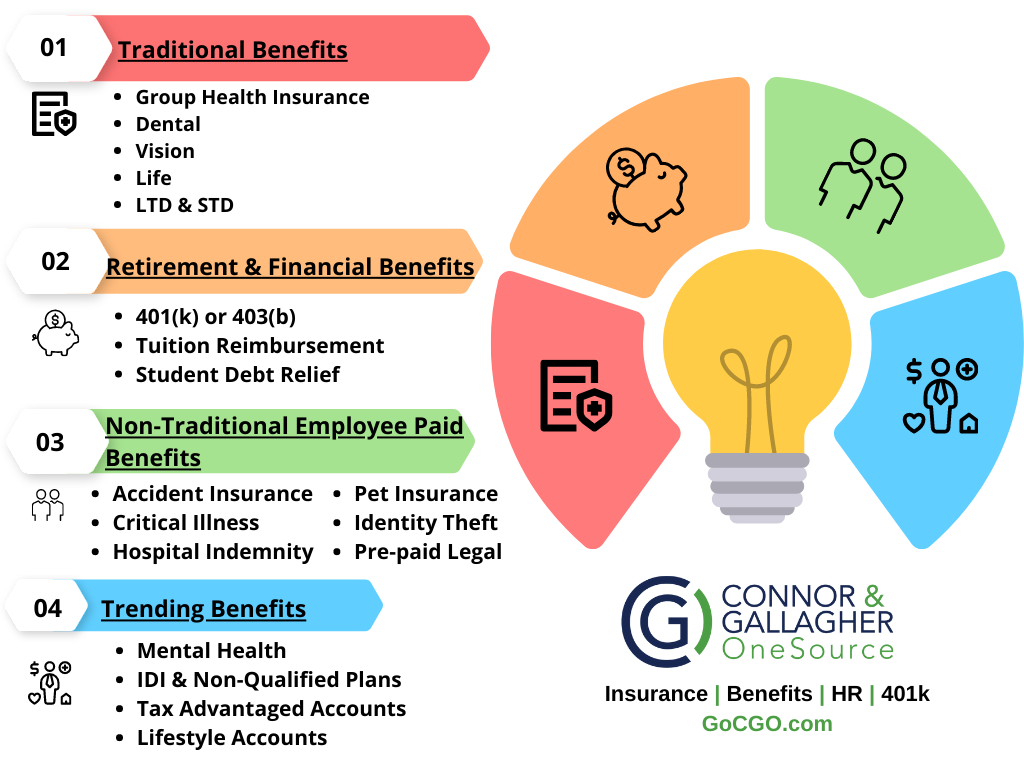

So what would a comprehensive benefits program look like?

Employee benefits package example

Key stat: Over 93% of firms with 50 or more workers offered health benefits in 2022. This percentage has remained consistent over the past 10 years (source: Kaiser Employer Health Benefits 2022 study).

Let's start with the foundation of your employee benefits package - traditional benefits. You need to solve this part first as it's typically the most important benefit to employees. That means having a solid health insurance plan, and an option for dental, vision, life insurance, long-term disability and short-term disability.

- Group health insurance plan - covers medical costs for employees and their families in the event of illness, injuries, or accidents.

- Group dental insurance - covers a range of dental services such as routine cleanings, X-rays, fillings, extractions, and even more complex procedures like root canals and orthodontic treatments.

- Group vision insurance - provides coverage for various eye-related expenses, including regular eye exams, prescription eyewear such as glasses or contact lenses, and other eye-related procedures.

- Employer-paid life insurance - provides financial security to employees and their loved ones. This type of insurance typically covers a predetermined amount, often equivalent to the employee's annual salary, and provides a lump sum payout in the event of the employee's death.

- Group long-term disability insurance - protects employees from the financial burden that may arise in the event of a disabling illness or injury for an extended period of time. Provides employees a percentage of their income for a predetermined period of time (usually varies from 2 years to retirement age).

- Group short-term disability - provides employees a percentage of their income for a predetermined period of time (typically 3-6 months). This duration may vary according to the policy and can range from several weeks to several months, after a waiting period.

These are the first six boxes that we look to check for our clients and you should also consider adding to this core benefits list an employer-sponsored retirement plan which leads us to the second building block of our employee benefits package example.

Key stat: 69% of private industry workers had access to employer-provided retirement plans as of March 2022 (source: U.S Bureau of Labor Statistics).

A 401k plan (or 403b plan if you're a nonprofit) is a very important part of an organization's total benefit package. For many Americans, the 401k is going to be their primary account for retirement savings. At some point everyone is going to want to retire. And having a great employer sponsored retirement plan available to your employees is a huge help towards generating enough income for retirement.

Financial wellness will continue to be an important part of the benefit package. Many times there's a direct correlation between a great employee that's engaged with your company and that employee's financial well-being. For that reason, we also recommend exploring tuition reimbursement and student debt relief benefits.

- 401(k) or 403(b) - Employer-sponsored retirement plans can provide several benefits for employees, including tax-deferred savings, employer contributions, and professional investment management.

- Tuition reimbursement program - a Section 127 plan allows an employer to reimburse up to $5,250 (as of 2023) per year to eligible employees tax-free for qualified education expenses.

- Student loan assistance - This program helps individuals pay off their student loans by providing financial support up to a certain amount each year.

Key stat: 44% of employers now offer some sort of supplemental health line.

We've seen a growing interest in non-traditional employee-paid benefits from our clients and significant growth in employee participation in these benefits. And as deductibles have grown and benefits have gotten a lot more expensive we believe these employee-paid benefits serve a valuable role in an employee benefits package lineup. Accident insurance, critical illness insurance, and hospital indemnity insurance are especially valuable if you offer a high-deductible health plan as it can provide a layer of backup protection should an employee or their dependents experience one of these events that can come with a significant financial expense.

And as an employer, you don't have to contribute anything to the cost of these benefits. So you can make a valuable benefit available to your employees that's 100% paid for by them and there's a ton of great insurance carriers out there to purchase these insurance products from. There may even be some bundling discounts with your medical carrier available.

- Group Accident insurance - pays employee cash (based on schedule) for unexpected injury or illness do to an accident. Typically ($50 - $5,000) per incident depending on severity with typical monthly cost being in the $15 per month range.

- Group Critical illness insurance - pays employee lump some benefit upon diagnosis of one of a set list of critical illness. (ex; Cancer, Heart Attack, Stroke, Organ Failure) Anywhere from $10,000 - $30,000 depending on benefit elected for a monthly cost of anywhere from $20 - $80 depending on enrollment type. (Single v. Family)

- Group Hospital indemnity insurance - pays a flat cash amount (sometimes varying by # of days) for hospital admissions. Very helpful in the age of high-deductible plans to help members manage deductible expenses.

- Group Pet insurance - covers a range of veterinary expenses including routine check-ups, vaccinations, and emergency medical treatments.

- Group Identity theft protection - provides financial protection to employees in the event of fraudulent or unauthorized use of their personal information. This type of insurance typically covers expenses incurred as a result of identity theft, including legal fees, lost wages, and the cost of restoring one's credit and financial standing.

- Group pre-paid legal program - designed to provide members with affordable and convenient access to legal representation for a wide range of legal issues such as estate planning, employment law, real estate matters, and more

There's a number of emerging, new benefits, that have become available due to recent legislation and the needs of today's employees so we picked 4 of these trending benefits as part of our employee benefits package example.

- Mental health

- IDI & non-qualified plans

- Tax-advantaged accounts: FSA, HSA, limited purpose FSA, and HRA

- Lifestyle accounts

Mental health: there may be nothing more important to employees right now than mental health. Employers can offer mental health programs to their employees to provide an outlet and solution to help their employees with their mental health challenges. This is one of the most impactful ways employers can show their employees that they care about them and their well-being and it's an inexpensive benefit to offer. Many employers don't even realize an EAP (employee assistance plan) may already be available to them and their employees if bundled with their other ancillary insurance coverages. Chances are if you have group life insurance, long-term disability, and short-term disability, then you probably do have an EAP that is provided to your employees by your insurance carrier because of the fact that you have those other coverages. EAP's will not only coordinate care to a provider of a facility within their benefit plan, but also transition management to additional providers such as devoted therapy for more mental health help. Many bundled EAP services offer a resource library, especially on the topics of mental health and financial services.

IDI : There's often a wage gap in long-term disability (LTD) plans. Generally, an employer-sponsored LTD plan benefit will max out at about a $10,000 or $15,000 monthly benefit. For your higher wage earners, that might not be sufficient. So there's a product available called individual disability insurance (IDI). Think of it as an individually owned policy through your employer that is sponsored on a group basis, typically offered to a select group of employees. This is a great benefit for your high-earning, key employees. It is generally fully portable, less expensive to get through an employer than it would be for an individual to get on their own in the individual disability market, sometimes guaranteed issue available or limited underwriting.

Non-qualified plans: A way for your employees to strategically supplement their 401(k) plan. Allows select employees to defer taxable income with no limits. If someone is already maxing out their 401k and is looking for an option to be able to save more, this is a great way for them to do this. In can be employee or employer funded and there are a number of ways to set it up. It's not for every employer, there is some testing and requirements that have to be met, but it can be a really powerful tool for recruiting and retention of key high-earning employees.

Tax-advantaged accounts: Most people know about HSA's and FSA's - they are incredible tax savings vehicles that can be hugely important to helping employees save up for medical expenses. But many employers don't know they can offer a limited-purpose FSA. A limited-purpose FSA is designed for employees who have an HSA plan (which then makes them non-eligible to have a FSA) but wish to contribute more savings. Under a limited-purpose FSA, an employee would be allowed to save for things like dental, vision, over-the-counter RX, etc. in addition to their HSA. HRA's are more of a strategy you'd combine with your health plan used to combat high premium increases. We've seen a big uptick in HRA's, especially in the past 2 or 3 years.

Lifestyle account: this newer type of account has been getting a decent amount of publicity lately. An employer can set up a lifestyle account on behalf of an employee, the employer can then put money aside into this lifestyle account for the employee to spend but only on a list of eligible expenses that you as an employer determine. Some examples of eligible expenses include mental health, personal development, certifications, and child care. This account is taxable, there's no tax advantage to lifestyle accounts. But if you're looking to help your employees financially with a particular thing, and you don't want to just give them the extra income because you're unsure they'll use it on that particular thing, then a lifestyle account might be a great option for you.

In this blog we covered an attractive employee benefits package example that featured 19 different types of benefits you can offer to your employees. There are certainly many more benefits that we can help you secure as an employee benefits insurance broker, but we believe offering these particular benefits represents a comprehensive employee benefits package to competitively attract and retain talent. We hope you were able to come away with some ideas that you can take back to your organization to add to your program to make your employee benefits package better for your employees.

If you'd like more information on "how do I make my employee benefits better," we put together a video to discuss these benefits and more in greater detail.

We've got a great team of people that love what they do and care about their clients. We have experts in each of the areas of employee benefits, business insurance, retirement plans, HR consulting, payroll, and HRIS support. We're standing by to help you and your organization with any of these services. Please email us at info@GoCGO.com if you have any questions or if you'd like chat with one of our team members.

You can find more about our services here:

- Health insurance broker

- Business insurance broker

- Employer Sponsored 401k Plan

- HR outsourcing, Payroll & HRIS

Author

Luke Barnett

Managing Partner, Practice Leader Employee Benefits

Connor & Gallagher OneSource (CGO)

.png?width=3000&height=2250&name=Copy%20of%20CGO%20Service%20Divisions%202023%20(1).png)

This blog is for educational and/or informational purposes only and does not constitute legal advice.