The 8 Biggest Takeaways From LIMRA/EY’s 2022 Workforce Benefits Report

The benefits industry is rapidly evolving between the creation of new technology, generational workplace shifts, the growing popularity of hybrid work environments and more. That’s why LIMRA and EY partnered to survey over 800 employers and over 1,200 employees, and interview 25 brokers and 18 benefit technology providers “to identify the most important changes that will shape the workplace benefits market over the next five years.”

In their research, LIMRA and EY identified 5 key megatrends that stakeholders believe will influence the industry the most. These include:

- A more heterogeneous and fluid workforce changes what, why and how benefits are offered

- Expanded benefits are key to meeting post-COVID-19 needs and winning the war for talent

- Brokers are valued, but their role is evolving rapidly toward strategic services

- Gaps in benefit awareness and understanding have made employee education and engagement burning platforms

- As digital transformation accelerates, the industry is ready for a fully integrated, data driven ecosystem

We’ve read this report front to back and are rounding up the key highlights of each megatrend in our recap. Keep reading to hear our take on LIMRA and EY’s report Harnessing Growth and Seizing Opportunity: The Future of Workforce Benefits.

2/3 of brokers say a multigenerational workforce will have a significant impact on benefits offerings

Our workforce has changed drastically in the last two years. Between the pandemic and Great Resignation, many have chosen to explore new career paths while hybrid and remote work environments have become the new usual. Additionally, the generational makeup of our workforce is changing too. As Gen Z enters the picture, most companies have 5 generations represented by their employees.

Each new generation equals different needs and preferences when it comes to what benefits they look for in a company. Employers need to ensure they understand what their workforce really needs to remain competitive in recruiting and retaining talent. For example, Gen Z entered the workforce in the height of the Covid-19 pandemic – naturally, their experience has been different than that of older generations, influencing how they view and value core and supplemental benefits.

Nearly half of Millennials view employer-provided benefits as more valuable now vs. pre-pandemic – 2x more likely than Baby Boomers

Gen Z isn’t the only generation with a shifting perception of benefits. Beyond core medical offerings, Covid-19 has “sparked newfound appreciation of the value of ancillary and nonmedical benefits” among Millennials as well. As people re-evaluate their priorities, many have realized they want employers who “genuinely care about their well-being, and benefits are the best way employers can demonstrate that.”

Since these two generations, Millennials and Gen Z, make up 40% of the workforce, it’s important that employers are meeting their needs to boost engagement and reduce turnover. The first step to doing this is understanding what your employees really want in their benefits package. Are they looking for better work-life balance? Then maybe consider flexible schedules or unlimited PTO plans. Are they looking for financial support? Then maybe consider unique financial benefits such as student loan repayment plans or financial literacy programs.

Employee interest in non-medical and non-insurance benefits is growing – driving 20% market growth over the next 5 years

According to LIMRA and EY, 80% of mid-sized and large employers believe employees will have more influence over benefits decisions in the future, yet only 23% of employers feel they completely understand their employees benefit needs. We believe employees are going to be more vocal and proactive about what they want with their employers this year and into the future. In return, employers must be receptive to that feedback to ensure their benefits package aligns with their workforce’s desires.

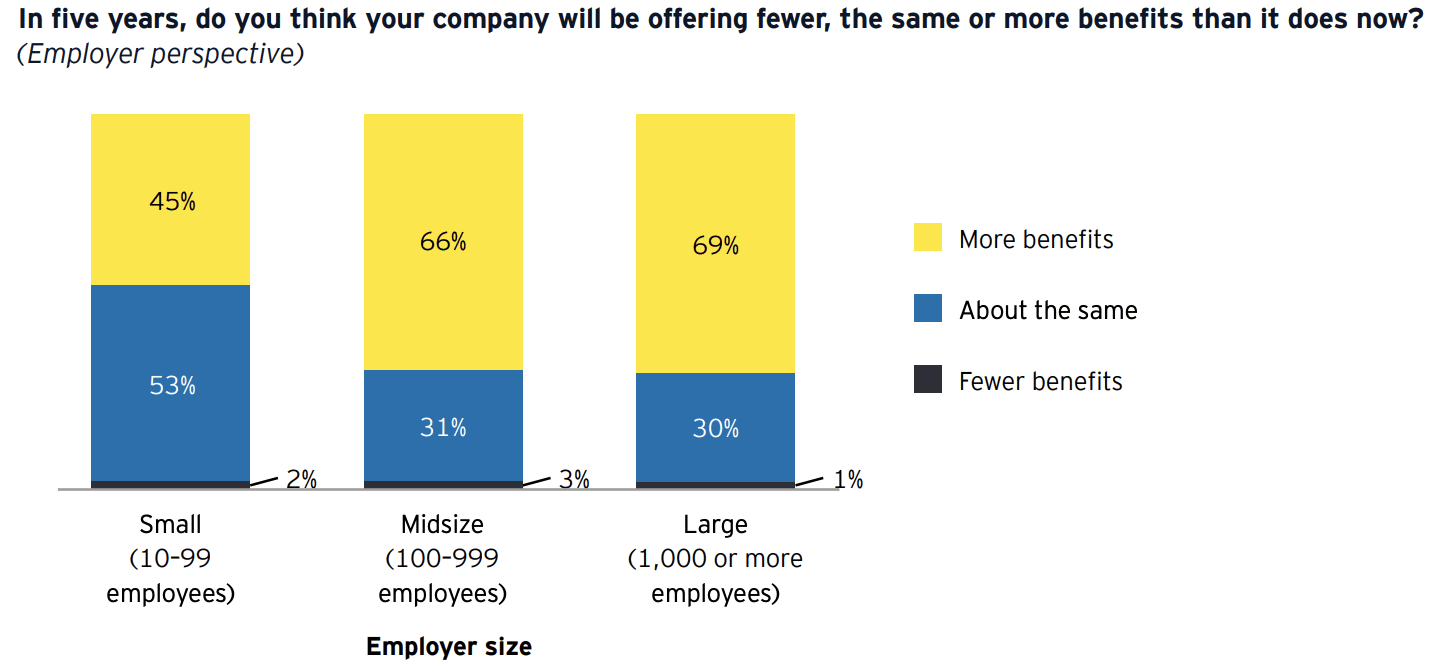

70% of large employers plan to offer more benefits over the next 5 years

These newer generations have propelled a new way of thinking regarding how to buy and use benefits – they want a greater role in managing their own healthcare. By putting more power and responsibility in the hands of the participants, employees are more knowledgeable about their benefits thus saving money for both themselves and their employers.

The key to setting your employees up for success in healthcare consumerism is providing them with the education and decision-making tools they need. HR teams need to think digital and mobile first to make these tools as accessible as possible so it’s easy for employees to take a consumerist approach.

More than 4 in 10 employers believe employees will pay greater share of benefits premiums over next 5 years

Offering nontraditional benefits also allows employers to expand their benefit offerings without drastic cost increases. While employers are predicted to offer a wider range of benefits, these are likely to be employee-funded – thus causing these unique offerings to rise in popularity.

Although expanding benefit offerings is a large undertaking for HR, benefit administration technology can simplify the process. Best-in-class providers have partnerships in place and can provide a curated list of benefit vendors for companies to choose from. These benefit ecosystem relationships are key to creating a seamless implementation experience for HR that keeps costs low and meets employee needs.

67% of mid/large employers expect to rely on their brokers more over the next 5 years

Deciding what benefits employees need, how to meet those needs and still be cost-effective at the same time is a difficult process. Most employers feel that their broker provides valuable support and advice in these processes beyond simply presenting various options. Designing benefit plans is less cut and dry than it used to be – now it’s a highly strategic decision.

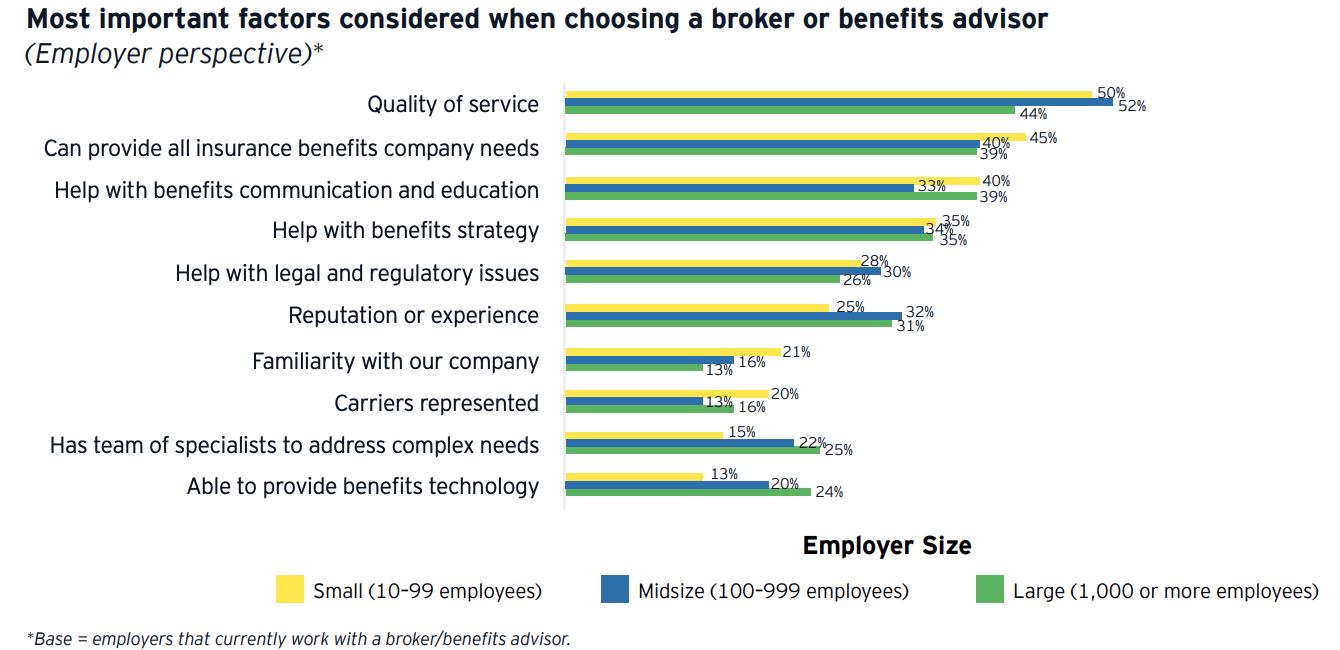

Additionally, employers need help navigating changing regulations and evolving benefit technologies. LIMRA and EY explain “as benefit complexity continues to increase and employers seek customized and flexible plans, they will turn to brokers for strategic guidance.” Brokers remain an important player in the benefits industry as employers highly value their quality service, communication and education assistance and strategic guidance.

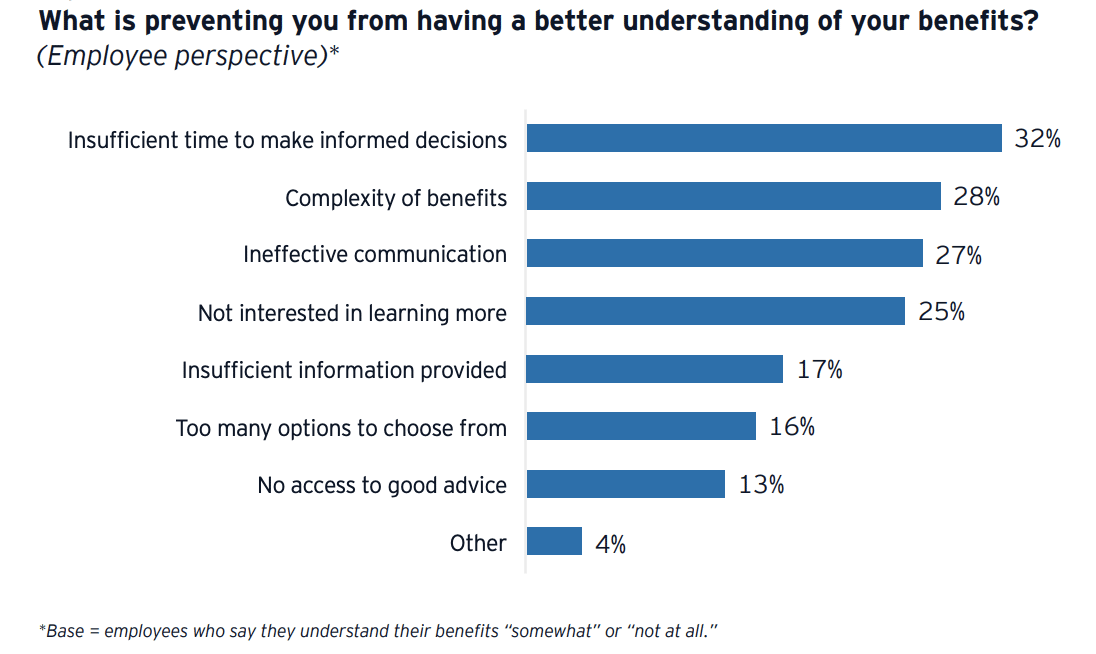

On average, 60% of employees feel employers don’t do a great job communicating to them about their benefits

Offering a wider range of nontraditional benefits will fall on deaf ears without proper communication and employee education. If surveying employee needs and finding offerings to meet said needs are steps one and two, then steps three and four include creating robust communication and education strategies. There are a multitude of barriers preventing employees from understanding their benefits including complexity, ineffective communication and insufficient information. Well-developed communication campaigns are key to preparing your employees for OE, helping them successfully enroll and reminding them how to use the benefit they selected. These campaigns should include a variety of touches from emails and text messaging to webinars and meetings.

Communication before, during and after OE will help ensure employees understand their options and know what to expect. Additionally, decision support tools can be another great strategy to help employees make the right benefit decisions for them. Unfortunately, not all decision tools are created equal. LIMRA and EY found that more than a third of employers do not have a decision support tool, and of those that do, 47% aren’t very satisfied with their effectiveness.

When selecting a benefits administration solution, look for a partner that has the software capabilities you need including key tools and functionalities backed by powerful AI/ML technology. As LIMRA and EY explained, “With more data available, artificial intelligence (AI) enabled tools can assess employee needs based on life stages and provide personalized recommendations, ultimately driving higher rates of employee adoption.”

8 in 10 employers believe technology will play a larger role in carrier selection over the next 5 years

Benefits technology is changing a lot more than just decision support tools. As brokers become strategists and employers’ home in on expanding and diversifying their benefits offerings, they “expect to rely more heavily on technology from all their partners, with software vendors topping the list.” In fact, 70% of employers say they will rely more on their benefits technology over the next 5 years.

Technology is a big player in the benefits ecosystem as a whole. LIMRA and EY found that “2/3 of employers say they would choose [benefit providers] that work well with their benefit technology platform, even if their product is a little more expensive.” Choosing a ben admin solution goes beyond software capabilities – employers want a partner who has a fully integrated, data-driven ecosystem with carriers and providers. Investments in carrier relationships and APIs create a more efficient benefit experience for both HR and employees alike.

Want to learn more?

Learn what other trends and predictions will make a splash in 2022 by watching our free on-demand webinar.

Additionally, read more about these statistics in the LIMRA and EY report: Harnessing Growth and Seizing Opportunity: The Future of Workforce Benefits.

Going Beyond Traditional Benefits Administration with PlanSource

Going Beyond Traditional Benefits Administration with...

Reseller Spotlight: The Cason Group

Reseller Spotlight: The Cason Group [rt_reading_time label="Read Time:"...

Fostering an Inclusive Workplace: The Power of Diversity and Employee Benefits

Fostering an Inclusive Workplace: The Power of Diversity and Employee...