The public sector is at a turning point as a significant part of the workforce approaches retirement.

These upcoming retirements present both challenges and opportunities across various public sector domains when it comes to recruiting and retaining the next generation of government workers.

To address these seismic changes, the public sector should consider how to increase its competitive benefit offerings further.

Earned Wage Access and the Public Sector

In recent years, earned wage access—also known as on-demand pay—has gained significant attention across multiple industries.

With an earned wage access platform, employees can access their earned pay before the traditionally scheduled paydays. This flexibility provides them with greater financial wellness, enabling them to make different decisions and avoid the expensive alternatives they’re using today.

While earned wage access has primarily been a benefit offered to employees of private companies, there is increasing interest in extending this benefit to government workers in the public sector.

In this blog post, we’ll explore why offering earned wage access for government workers is a valuable addition to government agency benefits programs. It can potentially improve public employees’ lives and help federal, state, county, and city governments attract and retain a workforce for the next generation of the public sector.

Improve Employee Financial Wellness

According to a 2023 Mission Square Research Institute study, nearly one in three public employee households would have trouble coming up with $400 in an emergency.1

One of the primary benefits of earned wage access is that it can improve employee financial wellness. It can help them pay for everyday expenses and even meet unexpected expenses without relying on predatory loans.

Additionally, with visibility of their earnings, workers can better plan their finances. They can calculate their potential earnings and take on more shifts or work extra hours to ensure sufficient funds are available in their next paycheck.

Reduce Financial Stress and Anxiety

Managing finances is a major stress for many employees. Nearly all hourly workers (93%) find managing their finances stressful, with 71% saying the stress has a negative impact on their mental or physical health.2

Offering earned wage access can help reduce this stress and anxiety by providing workers with greater financial control and flexibility.

This enhanced financial control can have a positive impact on employee productivity and job satisfaction, as workers who are less stressed and anxious are more likely to be engaged and focused on their work.

As the OPM’s Federal Workforce of the Future initiative outlines, employers must focus on how they can be more inclusive and engaged.

DailyPay’s financial wellness platform fits seamlessly into the OPM’s vision and provides employees with resources to feel more engaged, satisfied in their roles and supported by their employers.

Increase Pay Transparency

An earned wage access platform can help increase pay transparency. By providing workers with real-time access to their earned wages, agencies can demonstrate their commitment to fairness and equity.

For example, as awareness of the benefits of earned wage access becomes more well-known, workers across all age groups are recognizing its importance. Seventy-three percent of employers who offer DailyPay say it is an important piece or cornerstone to their approach to financial wellness benefits.3

Improve Retention and Recruitment

The public sector faces stiff competition when it comes to attracting and retaining top talent. Offering earned wage access can be a valuable tool in this effort, as it can help differentiate government agencies from private sector employers.

Address Talent Competition Challenges With Earned Wage Access

The public sector faces significant competition for talent from the private industry. This challenge is being exacerbated as more government workers approach retirement.

To address these challenges, public sector leaders have an opportunity to adopt a new approach to wages and benefits as they become more nimble and dynamic in their workforce practices to ensure adequately skilled staffing.

By doing so, they can not only fill the current gaps but also position themselves for success in the next generation of public sector employees. Predatory payday loans have a history of targeting military members despite efforts to protect them, such as The Military Lending Act.

Luckily, EWA provides another alternative for military members to gain a true financial lifeline without the crippling effects associated with payday loans.

Overcome Payday Loans

High-interest payday loans are a tempting trap for many. They appear to be a quick way to get access to a financial lifeline, but the costs far outweigh the perceived benefits.

One area where we see payday loans at a far disproportionate rate is with military service members.

In addition to payday loans, federal civilian or postal employees who have been employed with the federal government for over a year are eligible for an emergency hardship loan. To be eligible, employees must have suffered a hardship such as severe illness, injury, fall victim to a crime, and more. While this is a great option for those in dire need, there are many federal employees who won’t qualify for emergency hardship loans but would greatly benefit from the financial flexibility that earned wage access can provide.

Empower Public Sector Employees for the Future of Work

Although it will take much more than earned wage access to solve the recruitment and retention challenges faced by the public sector, by including it as part of their benefits offering, government employers can demonstrate that they value their employees and are committed to supporting their financial well-being.

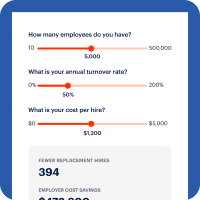

This approach can help improve employee retention rates, as workers who feel valued and supported are more likely to stay with their current employer. In fact, in a November 2022 DailyPay user study, 52% indicated their opinion of their employer has improved since they began using DailyPay.4

Discover how DailyPay can make a difference for your organization.

1 https://research.missionsq.org/content/media/document/2022/11/examining-financial-wellbeing-of-public-service-workforce.pdf:DailyPay, 2020

2 Harris Poll survey commissioned by Funding our Future and DailyPay, July 2023:DailyPay, 2020

3 DailyPay Employer Experience Research, Arizent study commissioned by DailyPay, September 2023:DailyPay, 2020

4 November 2022 DailyPay User Survey:DailyPay, 2020