A payroll advance, also known as a paycheck advance or salary advance, is a type of short-term loan that allows employees to access a portion of their earned wages before their regular payday.

A payroll advance is a financial agreement between an employer and an employee, where the employee receives a short-term loan from their employer. The loan is paid back to the employer with deductions from the employee’s future earned wages.

The amount advanced is usually a percentage of the employee’s expected wages, and it is deducted from their subsequent paychecks until the full amount is repaid. It’s important to note that payroll advances are different from payday loans, which are typically provided by third-party lenders and often involve higher interest rates and fees. Payroll advances are usually more favorable in terms of interest rates and repayment terms, as they are directly tied to an employee’s earned wages and are facilitated by the employer.

On-demand pay platforms like DailyPay are different and could be more financially responsible than payroll advances and payday loans, which are paid back to their employer from future earned wages. Whereas DailyPay allows users to access the wages that they’ve already earned in real-time.

Why Do Employees Ask For Paycheck Advances?

Life isn’t perfect and sometimes unexpected or expected payments do not align with your payday. Whether it’s for paying your bills or buying a last-minute birthday gift for your mom, sometimes you need your pay before payday. That’s why many employees choose to get their paychecks advanced.

Some of the main reasons employees may ask for a paycheck advance are:

- Rent or mortgage payments

- Utility or electric bills

- Car payments

- Credit card bills

- Insurance payments

- Transit to and from work

- Groceries

- Medical emergency/ medical bills

Everyone is different and has different reasons for why they need their money before payday. To make ends meet, 22% of hourly workers say they have taken out a payday loan in the year 2022, including nearly one-third (31%) of those aged 18 to 34. The bottom line is it’s a very common problem that many people need help with.

What’s the Downside of a Payroll Advance?

Payroll advances might sound like a good idea at the time but they can be costly to both employees and employers.

When employees get a payroll advance they are paid with funds that they have not earned yet. Most of the time the employees end up paying back the short-term loan with higher interest rates, which can create a vicious cycle for them.

Employers should also be wary of payroll advances. When an employer gives a paycheck advance, they’re fronting funds that an employee has not earned yet. If that employee quits or is terminated, the business is liable for the unpaid balance.

What Are Alternatives to Payroll Advances?

There are several alternatives to payroll advances that companies can consider to support their employees’ financial well-being. Some of these alternatives include

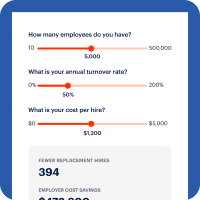

- Flexible Pay Options like on-demand pay or earned wage access. More and more companies today are adopting flexible payroll options, such as on-demand pay or earned wage access platforms. These services allow employees to access their earned wages in real time or before the regular payday. In a DailyPay-commissioned study by Aite Novarica Group, 4 in 5 of those polled stated that access to on-demand pay from their employer reduced their reliance on payday loans or overdraft fees.2 DailyPay is a leading provider of on-demand pay. Click here to schedule a demo or inquiry about the on-demand pay solution.

- Employee Assistance Programs (EAPs). EAPs are workplace programs designed to assist employees with personal problems that may affect their well-being and work performance. These programs often include financial counseling services, which can help employees with budgeting, debt management, and other financial concerns.

- Financial Education and Wellness Programs. Employers can offer financial education programs and workshops to help employees develop better money management skills. These programs can cover topics such as budgeting, saving, investing, and debt management. By equipping employees with the knowledge and tools to manage their finances effectively, employers can help reduce the need for immediate cash advances.

- Emergency Savings Programs: Employers can encourage employees to build emergency savings by offering programs such as automatic payroll deductions for savings accounts or matching contributions to employee savings plans. By promoting savings habits, employees can have a financial buffer to handle unexpected expenses without needing immediate access to their wages. On-demand pay benefits like DailyPay have options that encourage employees to set money aside effortlessly.

Find out more about how DailyPay can help you move away from payroll advances and toward the future of payroll.

1 Harris Poll study commissioned by DailyPay and Funding Our Future, 2022:DailyPay, 2020

2 DailyPay Use and Impacts: A Summary of Consumer Survey Findings, Aite Group commissioned by DailyPay (June 2021):DailyPay, 2020