Employee Cost: How to Calculate the Cost of an Employee?

HR Lineup

MARCH 29, 2024

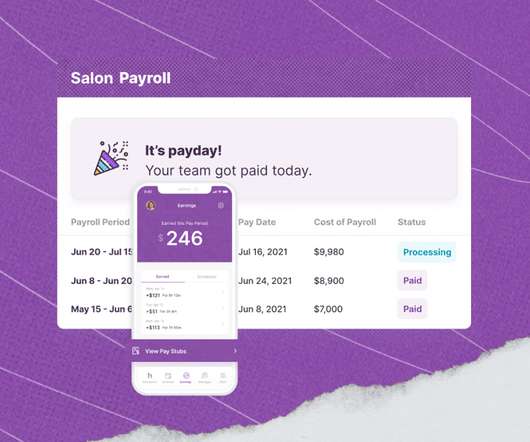

These include: Base Salary: The primary component of an employee’s compensation, typically determined by factors such as job role, experience, and market rates. Bonuses and Commissions: Additional incentives provided to employees based on performance, sales targets, or other predefined criteria.

Let's personalize your content