California Minimum Wage: What Small Businesses Need To Know

Homebase

NOVEMBER 7, 2023

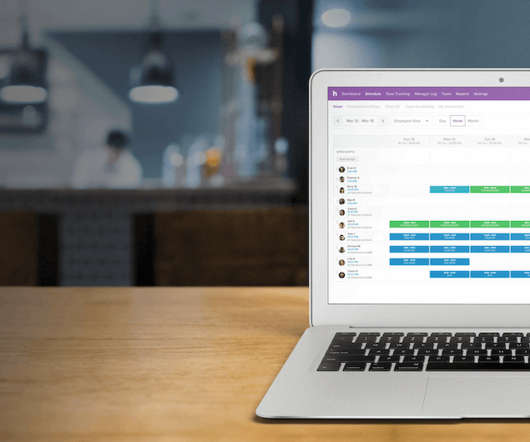

In 2016, California approved a statute to increase the minimum wage yearly starting in 2017. This period has now passed and the California minimum wage rate is at $15.50. According to a Zillow study, a person making minimum wage would need 2.7 Save time on payroll. Simplify payroll What is the California Minimum Wage?

Let's personalize your content