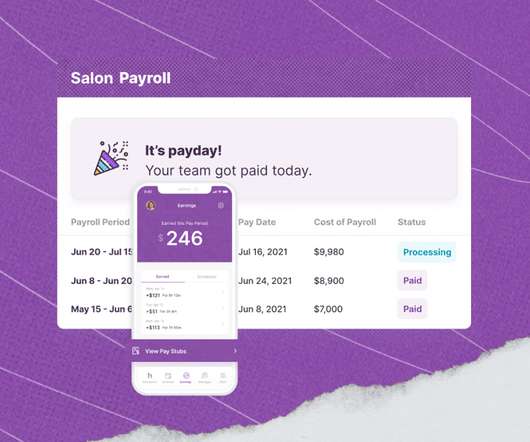

The power of payroll data: An interview with a leader in data management, BI, and people analytics

Visier

APRIL 15, 2021

Dave Wallis , Director of Analytics and Information Strategy at Insperity , is a long-time data management and BI professional, who’s currently focused on developing Insperity’s people analytics offering (in partnership with Visier). He has a deep understanding of how powerful data is for every area of the business.

Let's personalize your content