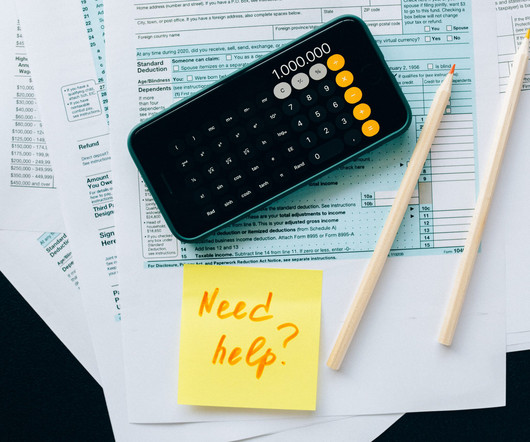

How to pay tips to employees: a guide for SMBs (2023)

Homebase

JULY 30, 2023

Some business owners are putting their businesses at risk by not paying the required amount of tax on the tips their employees receive. And even if they are paying taxes, it’s often up to busy managers to calculate tips correctly, which can be a complex process. Simplify payroll How do tip credits work?

Let's personalize your content