HR Strategy is crucial in times of crisis.

Tandem HR

APRIL 29, 2020

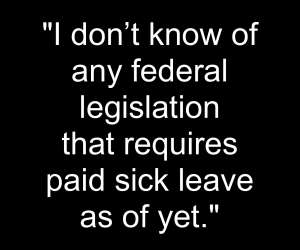

government quickly produced the Families First Coronavirus Response Act (FFCRA) and the CARES Act to help individuals and businesses struggling due to COVID-19. They have so many questions about eligibility for the benefits and tax credits, who needs to comply, and whether their business was considered essential.

Let's personalize your content