What Paid Family Leave Could Mean for Your Business

Cornerstone On Demand

FEBRUARY 25, 2018

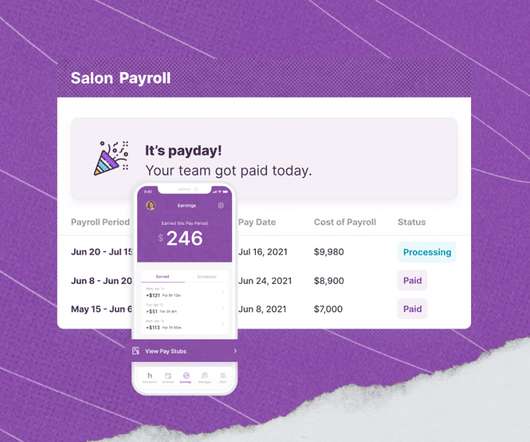

To alleviate the financial pressure of taking unpaid time off , there's been some recent political discussion about implementing a paid family leave through a payroll deduction, and some states, including California, Rhode Island and New Jersey, have already implemented plans. The payroll deductions range from 0.8 percent to 1.2

Let's personalize your content