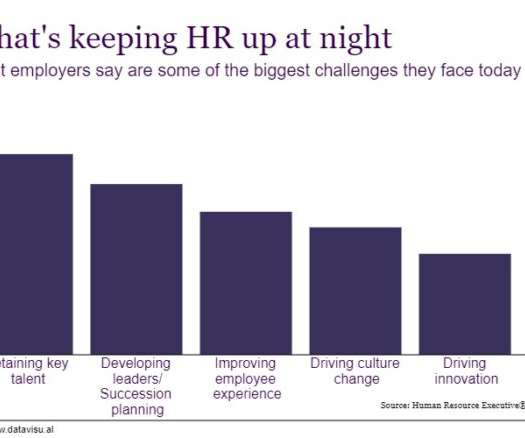

What’s Keeping HR Up at Night in 2020?

HRExecutive

FEBRUARY 17, 2020

million in January 2019 to 6.8 The number of job openings in the U.S. fell from 7.6 million in January 2020, according to the Bureau of Labor Statistics. Is this an early sign that the talent shortage is dwindling? But regardless of what those numbers reflect, HR professionals continue to worry about maintaining a skilled workforce.

Let's personalize your content