How leap years affect pay and benefits

HR Brew

FEBRUARY 28, 2024

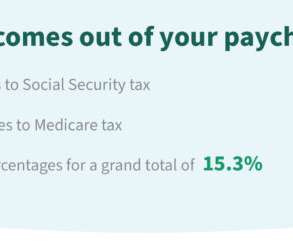

But what does that mean for pay and benefits? As February 29 approaches, a quick primer for HR pros on how payroll and benefits are affected during 366-day years: Workers paid on a weekly or hourly basis may see slightly higher pay. It’s a leap year, which means every worker gets an extra day to hit those February deadlines.

Let's personalize your content