Payroll Frequency: Deciding What’s Best for your Company

Netchex HR Blog

SEPTEMBER 14, 2023

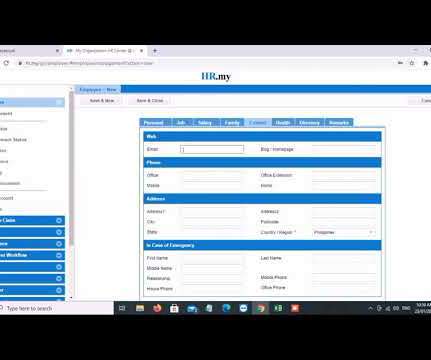

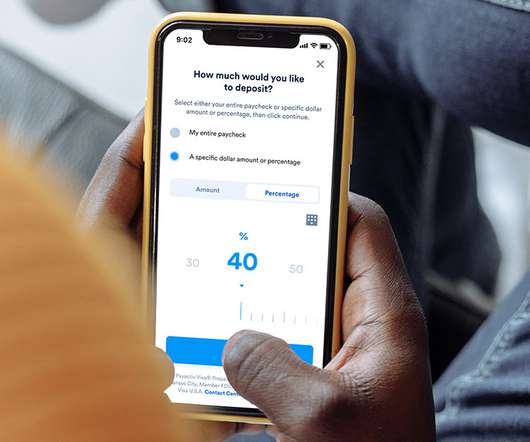

Payroll has changed a lot with HR software and automation. Some business routines like payroll frequency have been guided by the limits of manual payroll, not necessarily what’s best for the company. Which payroll frequency is best for your company and your employees? What is pay frequency?

Let's personalize your content