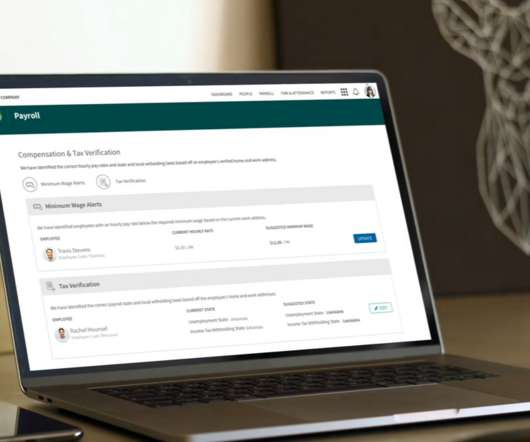

What is International Payroll Processing?

Recruiters Lineup

JULY 14, 2023

In a world where businesses are expanding globally and embracing diverse workforces, managing employee payroll across borders poses unique challenges. International payroll processing emerges as the solution, ensuring precise and timely compensation for employees in multiple jurisdictions.

Let's personalize your content