Employment Tax Processing: Just Because You Can Doesn’t Mean You Should

HR Bartender

JULY 11, 2023

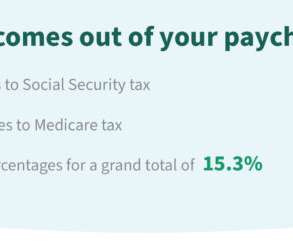

You can stay up to date on HCM topics with the ADP Spark blog. A great example of this is my taxes. Can I prepare my own taxes? The time I spend doing tax-related stuff could be better spent generating revenue by working on client projects or building my business. I must keep my employment tax knowledge current.

Let's personalize your content