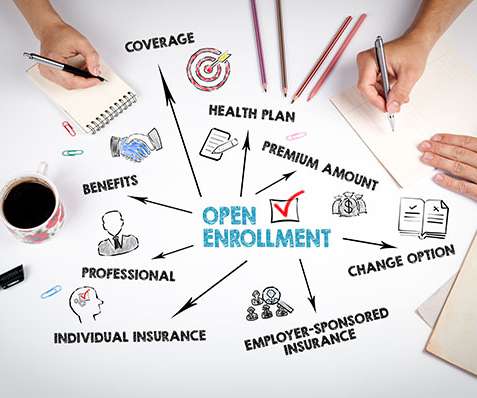

Flexible Spending Account, secret benefits you don’t know about

HRNasty

NOVEMBER 16, 2023

Yes, FSA covers Lasik, PRK, and SMILE to name just a few procedures Flexible Spending Account Explained “I tried the Flexible Spending Account and lost a lot of my money! The Flexible Spending plan is a rip-off.”

Let's personalize your content