The Best Payroll Software For Small Businesses

TrustRadius HR

JULY 6, 2022

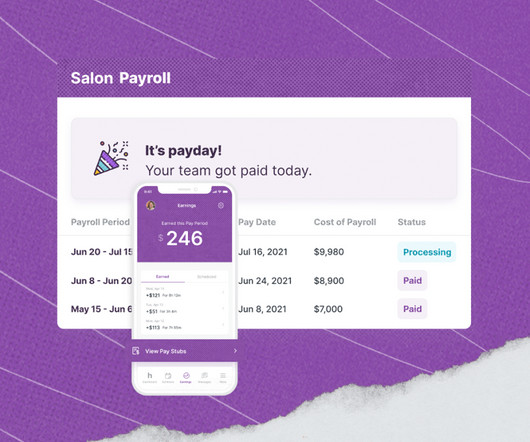

The average small business owner spends nearly five hours per pay-period processing payroll (Try saying that five times fast). This gives you most of that five hours back to invest elsewhere in your business. The second benefit is accuracy. Does the software administer retirement accounts?

Let's personalize your content