Guide to Hiring Employees in Ukraine

Recruiters Lineup

JANUARY 15, 2024

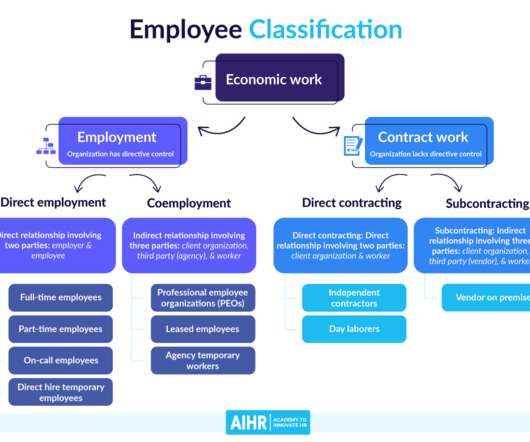

Understanding Legal Framework in Ukraine When expanding a business to Ukraine and engaging in the hiring process, it is imperative to have a comprehensive understanding of the legal framework governing employment relationships in the country. Each type comes with its own set of legal obligations and rights for both employers and employees.

Let's personalize your content