Top 6 ADP alternatives & competitors (in-depth comparison)

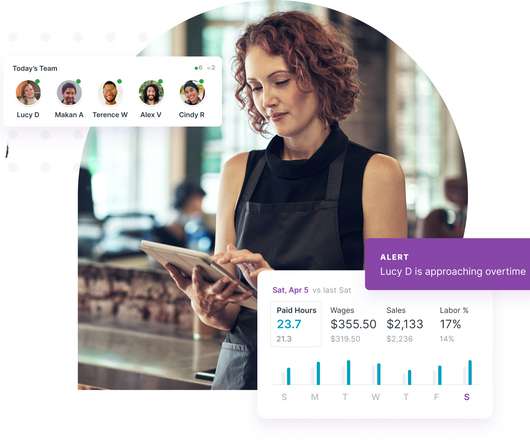

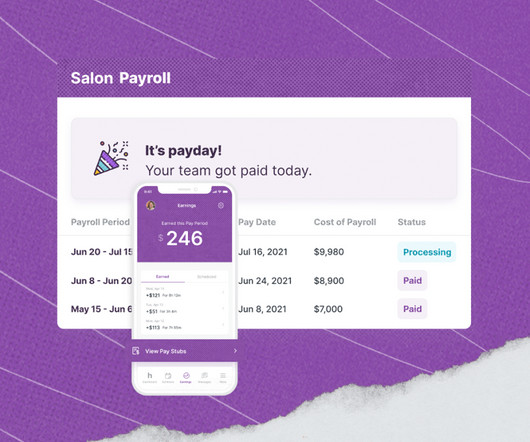

Homebase

MAY 30, 2023

That’s why you’re looking for HR software that can take some tedious admin tasks off your hands. Perhaps you came across the leading solution, ADP, after a quick Google search. At least now you have a better idea of what you’re looking for — a platform similar to ADP with a few key changes to suit your needs.

Let's personalize your content