86ing High Turnover: How to Reduce Restaurant Turnover with HR Technology

Netchex HR Blog

AUGUST 17, 2023

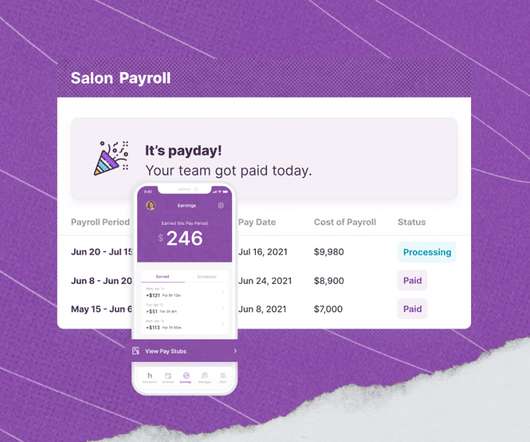

DISCOVER: Top HR Trends: Recession, Retention, DEI, and More HR software can help you reduce restaurant turnover and provide more support to current staff at your restaurant by improving your back office processes and enhancing the employee experience. Compensation: Between tips and hourly wages, some workers leave for better opportunities.

Let's personalize your content