How Does Payroll Outsourcing Maximize the Efficiency of Your HR Team

Hppy

APRIL 11, 2021

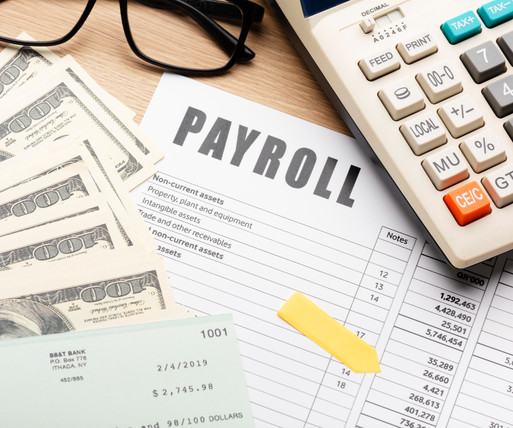

Payroll is a critical part of HR management and is a time-consuming activity that needs to be performed every month. The HR managers are forever shrouded with the pressures of managing compliances and following the regulations when handling payrolls. The activities of payroll management are related to business operation.

Let's personalize your content