How to Ensure You Are Meeting the New 401K Standards

Effortless HR

JANUARY 27, 2020

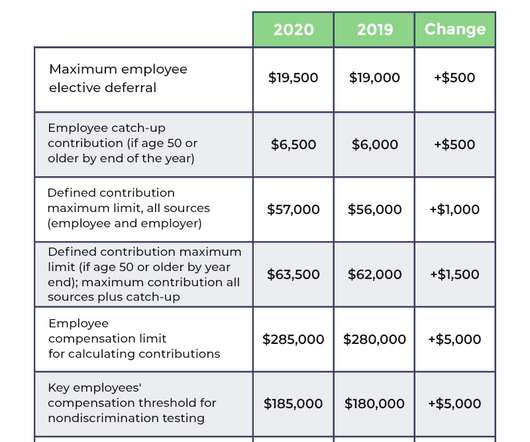

If you’re unsure about how to meet the new 401k standards, here are some ways to help you do so efficiently. Any good 401k advisor can help you to pick out a line-up of at least three different investment options. Rather, stick to three basic ones that will make your 401k plans meet the federal standards.

Let's personalize your content