Home Health Payroll & HR Software: Taking Better Care of Caregivers

Netchex HR Blog

FEBRUARY 6, 2024

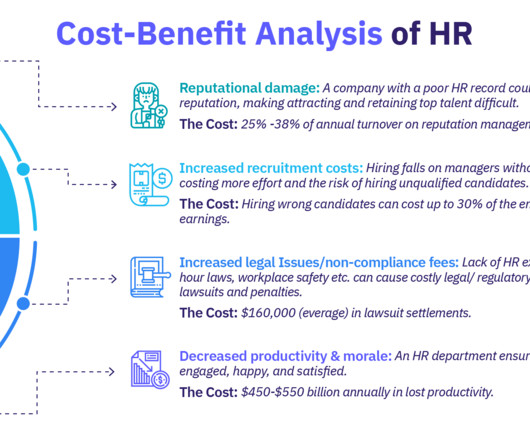

READ: 86ing High Turnover: How to Reduce Turnover with HR Technology Compliance As if federal regulations weren’t complicated enough, you need to follow any state regulations that address everything from hourly wages to healthcare procedures. Emerging and popular perks and benefits include a variety of employee wellness programs.

Let's personalize your content