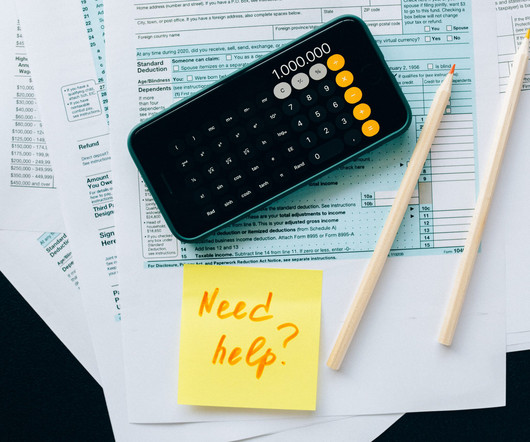

Top 15 Tips to Track Payroll Metrics

HR Lineup

FEBRUARY 9, 2024

Payroll management is a critical aspect of any business, regardless of its size or industry. Accurate and efficient payroll processing ensures that employees are compensated correctly and on time, while also helping businesses comply with various regulations and tax requirements.

Let's personalize your content