Want a Career in Human Resources? Your In-Depth (2023) Guide

Analytics in HR

SEPTEMBER 7, 2023

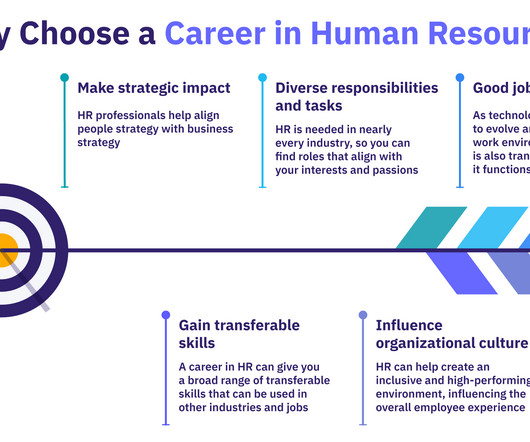

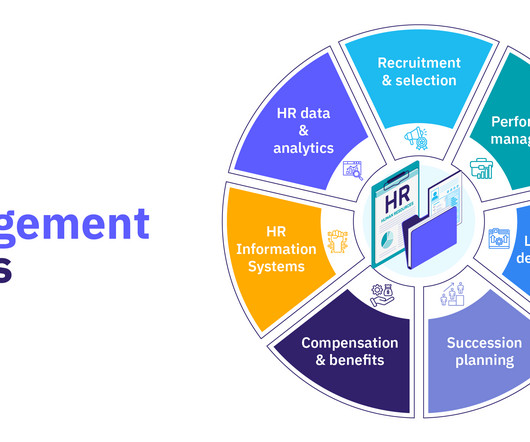

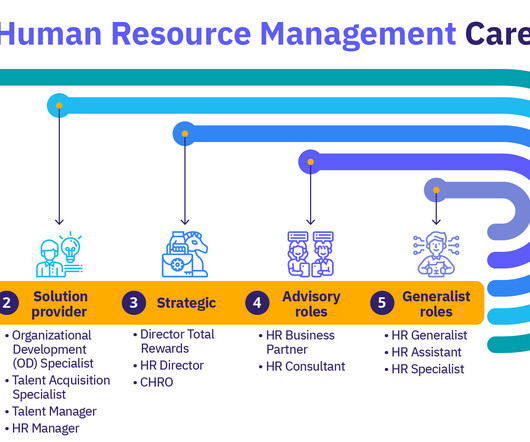

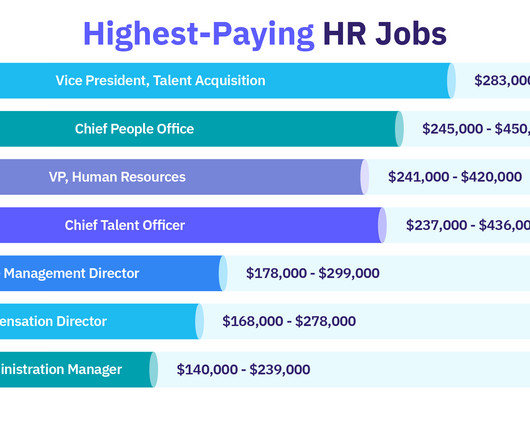

Embarking on a career in human resources opens opportunities for you to support employee growth and drive organizational success. The demand for HR services and software continues to grow. Contents What does a career in Human Resources look like? And not only that.

Let's personalize your content