IRS Raises Several Annual Retirement Plan Limits for 2019

HR Daily Advisor

NOVEMBER 6, 2018

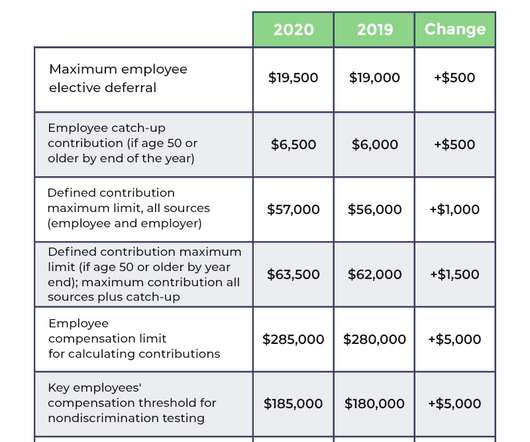

For 2019, the Internal Revenue Service (IRS) is raising most of the annual threshold and benefit levels that apply to retirement plans, the IRS announced on November 1. Employers and retirement plan administrators can apply the new rates as they prepare their plans for next year and conduct nondiscrimination testing.

Let's personalize your content