Payroll & Tax Processing: Understanding the Intricacies

PCS

NOVEMBER 7, 2022

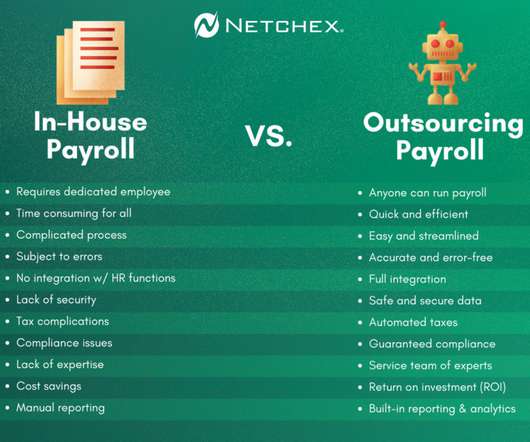

Companies that require payroll and tax services must employ a highly reliable third-party provider to reduce the pressure from their HR and Accounting departments. Managing payroll is quite burdensome especially if done manually. Payroll Preparation & Tax Filings. Payroll Preparation & Tax Filings.

Let's personalize your content