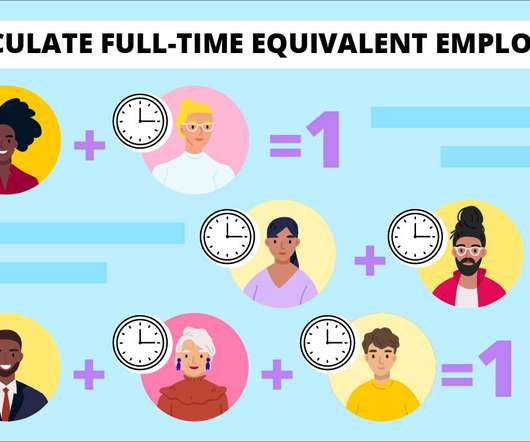

How to Calculate a Full-time Equivalent Employee for the PPP Loan, ERC, & More

Patriot Software

JUNE 29, 2020

The post How to Calculate a Full-time Equivalent Employee for the PPP Loan, ERC, & More appeared first on Patriot Software. Whatever the case may be, you should know how to calculate a full-time equivalent […].

Let's personalize your content