Want a Career in Human Resources? Your In-Depth (2023) Guide

Analytics in HR

SEPTEMBER 7, 2023

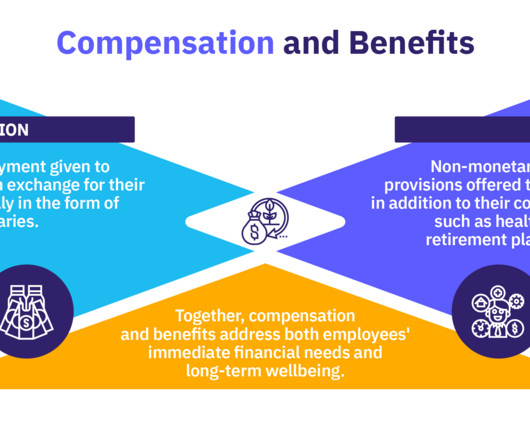

Compensation and benefits : HR ensures that employees are well cared for by giving them competitive salaries and benefits. HR also manages payroll and prepares and documents HR policies and procedures. In benefits and payroll, HR must be diligent with deadlines to ensure employees receive their salaries on time.

Let's personalize your content