HRIS Requirements Checklist: A Guide for Getting Started

Analytics in HR

JULY 27, 2021

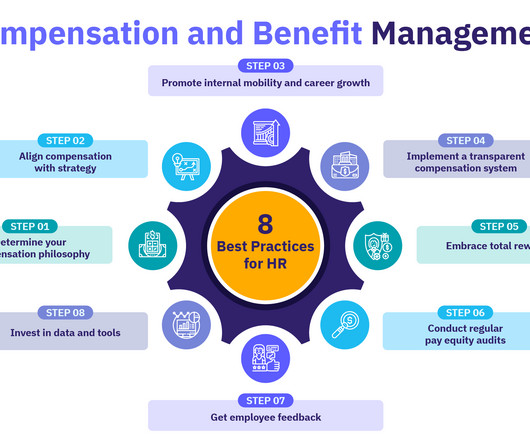

It integrates and consolidates multiple functions like employee records, time off, payroll, and benefits in one place. Financial/Payroll management. In other words, you need to have financial and payroll management features on your HRIS requirements checklist. Benefits management. An HRIS should govern benefits administration.

Let's personalize your content