Common Payroll Mistakes and How a PEO Can Help Avoid Them

Extensis

JUNE 8, 2023

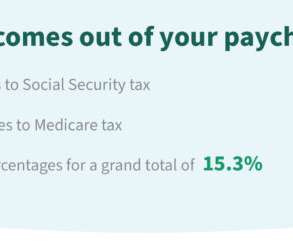

Tips for Keeping Your Business Compliant and Productive Quick look: Managing payroll can be complex and time-consuming, involving multiple tasks like calculating wages, withholding taxes, and filing reports. With so many moving parts, it’s no surprise that payroll mistakes happen and can have serious consequences for businesses.

Let's personalize your content