How to Become a Human Resources (HR) Manager: The Definitive Guide

Analytics in HR

JULY 10, 2023

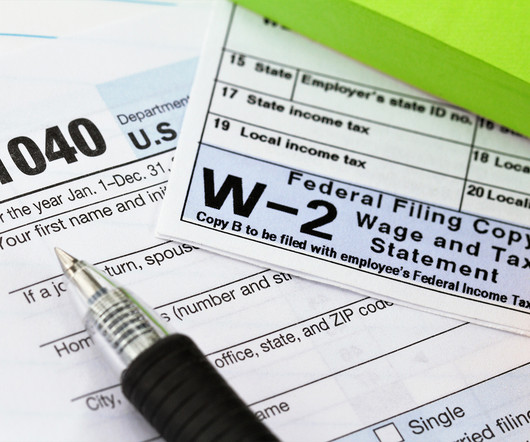

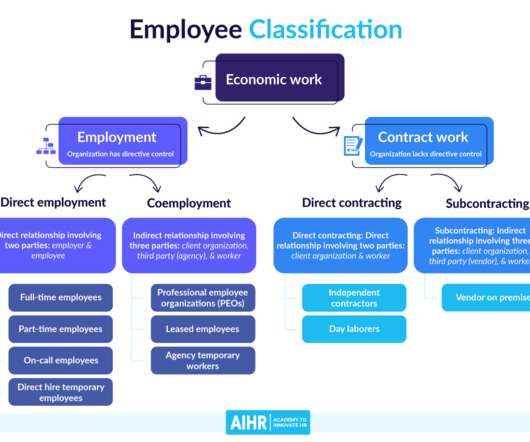

Contents Definition of Human Resources Manager What does a Human Resources Manager do? Compensation and benefits : HR managers oversee compensation and benefits programs, ensuring competitiveness in the market, managing payroll, and administering employee benefits packages. Let’s dive in!

Let's personalize your content