Paycheck Protection Program: How to Ensure Your Business is Eligible for Loan Forgiveness

Netchex HR Blog

JUNE 3, 2020

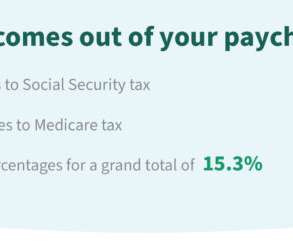

Part of the CARES Act passed in March (and then replenished a month later ), the Paycheck Protection Program (PPP) is a loan program for small businesses designed to provide a direct incentive for keeping their workers on the payroll. How are “payroll costs” defined under the PPP? June 3, 2020.

Let's personalize your content