Hiring Top-Performing Human Resources Managers

PCS

AUGUST 1, 2023

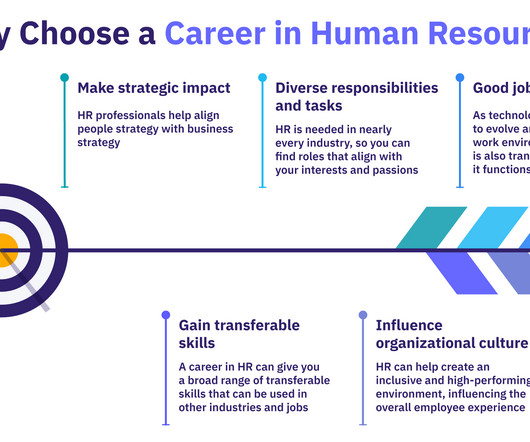

Educate employees about employment laws. Coordinate benefits and retirement for employees. To be specific, HR managers must be capable of achieving the following: Work with all managers to address complicated business concerns. Know how to use HR technology like the Cloud-based Human Capital Management (HCM).

Let's personalize your content