8 Challenges Small Business HR Professionals Face in 2020

Zenefits

SEPTEMBER 2, 2020

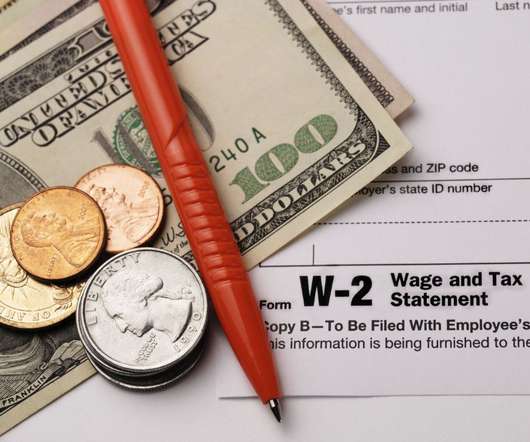

Some areas to get ready for — for HR and owners — are likely challenges everyone is facing in 2020. For HR professionals, sick time — once a payroll check-the-box issue — has come to the forefront. For HR professionals, layoffs, slowdowns, juggling schedules, and even making payroll have been difficult. Compliance.

Let's personalize your content