What is Hire-to-Retire (HTR)?

HR Lineup

SEPTEMBER 24, 2024

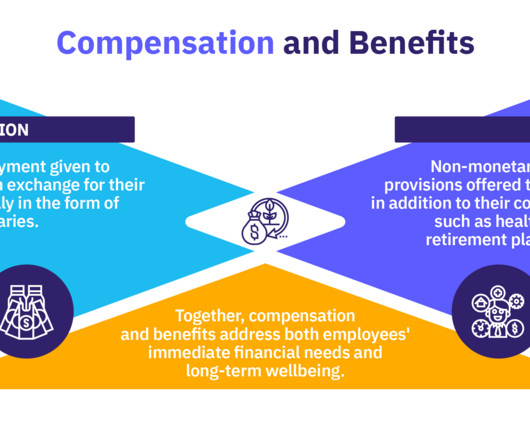

Recognition and Rewards: Providing recognition, incentives, or promotions for outstanding performance. Incentives and Bonuses: Providing additional financial incentives, including performance-based bonuses, profit-sharing, and stock options.

Let's personalize your content