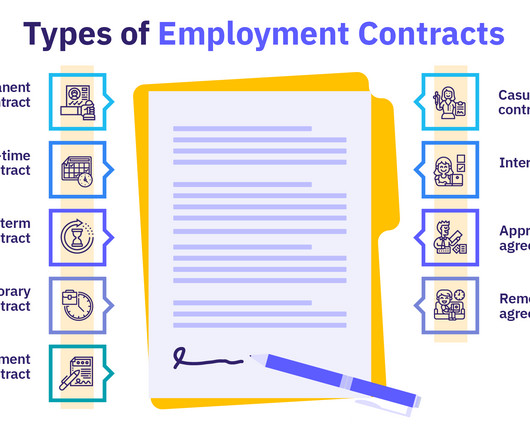

21 Types of Employment: Your Hire-To-Retire Guide

AIHR

NOVEMBER 12, 2024

However, top candidates are usually off the market in just 10 days. Apprenticeship An apprenticeship is a structured training program that offers hands-on experience and technical skills under guidance from experienced professionals. Working hours: Typically full-time but can vary by role and company policies.

Let's personalize your content