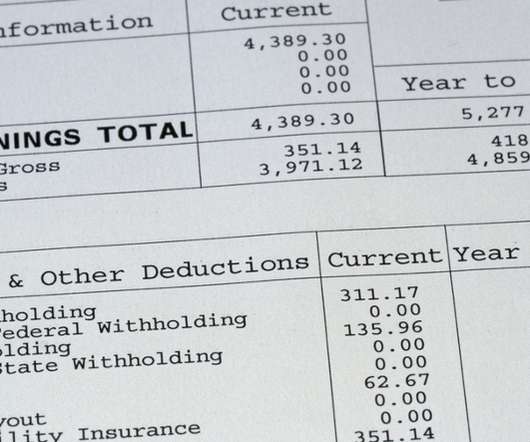

5 Quirky or Rare Payroll Laws Your Clients Won’t Need to Know

Prism HR

MARCH 27, 2024

There’s compliance, overtime, taxes and the list goes on. Not to mention that many PEOs support clients in states that have different rules and regulations to follow regarding payroll. Without advanced technology that can help keep your clients up to date on payroll regulations, the struggle is real. Perhaps impossible.

Let's personalize your content