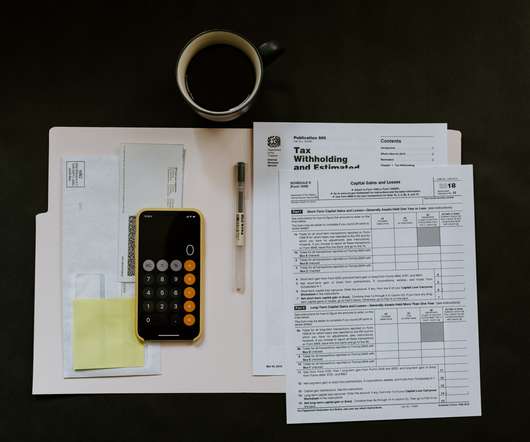

Creating a Contractor Value Proposition

LiveHire

AUGUST 15, 2023

These Contractor Value Propositions (CVP) work the same way as EVPs; they must highlight the benefits of working with the employer but take into account the difference between full-time and contingent workers. In this blog, we’ll discuss some ways to improve contingent sourcing with a compelling Contractor Value Proposition.

Let's personalize your content