Top 10 Healthcare & Compliance Blog Posts from 2020

Precheck

JANUARY 4, 2021

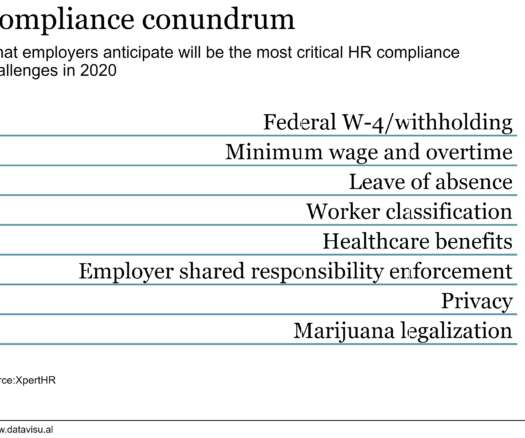

Top 10 Healthcare & Compliance Blog Posts from 2020 Jan. As I compile PreCheck’s annual list of most popular blog posts this year, I am reminded of everything that we faced in 2020. Here’s the PreCheck Blog’s top 10 most read articles from 2020. In 2020, the U.S. Marijuana Laws and the 2020 Elections.

Let's personalize your content