5 Things We Learned About the Future of Work From Heather McGowan at Thrive 2022

15Five

DECEMBER 9, 2022

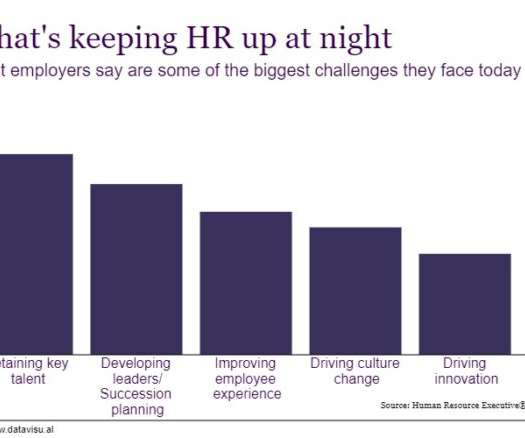

Read on for five of our key takeaways from Heather’s insightful and inspiring presentation. It is notable that compensation and opportunities for growth/learning were tied for number presenting a profound opportunity for both HR and L&D professionals. . Investors want to put their money behind companies investing in DEIB.

Let's personalize your content