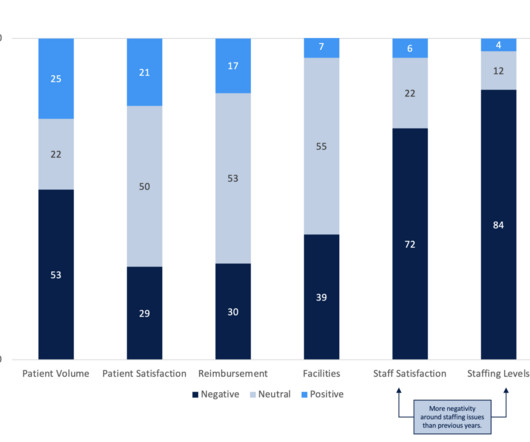

Succession Plans – Beneficial Across All Categories

Hospital Recruiting

APRIL 30, 2019

Most private practice physicians plan their retirement well in advance. It’s estimated that though 2029, 10,000 Baby Boomers will retire from the workforce every day. Succession planning across all categories. These top tools should be part of your overall talent plan, from recruitment to retirement.

Let's personalize your content