3 Reasons to Pay Your Tipped Employees With Automated Cashless Tips

Payactiv

JANUARY 27, 2022

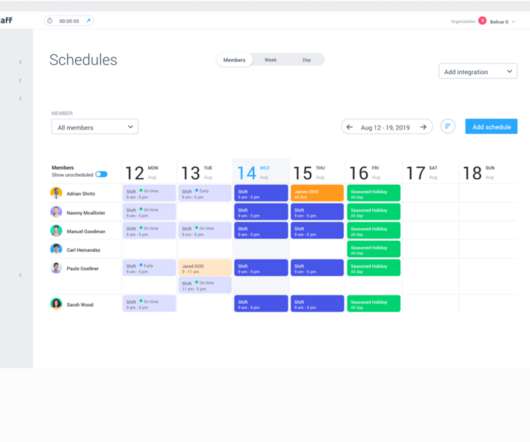

The use of credit and debit cards have allowed patrons to give tips without leaving actual cash or coins between the billfold. . This is just one of many problems with manual tip disbursement systems. . Find out why it’s time for employers to make the switch to digital tip disbursements today. Consider Safer Cashless Tips.

Let's personalize your content