4 Compliance Strategies that Create Labor Efficiencies

HR Bartender

FEBRUARY 22, 2022

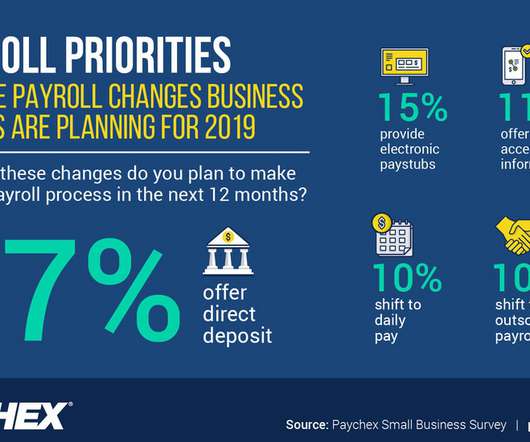

So, making sure that organizations have the systems in place to properly manage the payroll process is vital. That includes compliance with employment tax payment and reporting rules with each of the various local, state, and federal agencies to avoid penalties. The entire organization needs to be involved.

Let's personalize your content