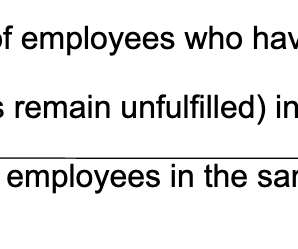

Overstaffing: Why It Happens and How To Avoid It in 5 Steps

Analytics in HR

DECEMBER 11, 2023

In this blog post, we’ll look at how it happens and provide tips on how to avoid it so your organization enjoys maximum efficiency. Overstaffing vs. understaffing Why does overstaffing happen? But what causes overstaffing in the first place? Contents What is overstaffing?

Let's personalize your content